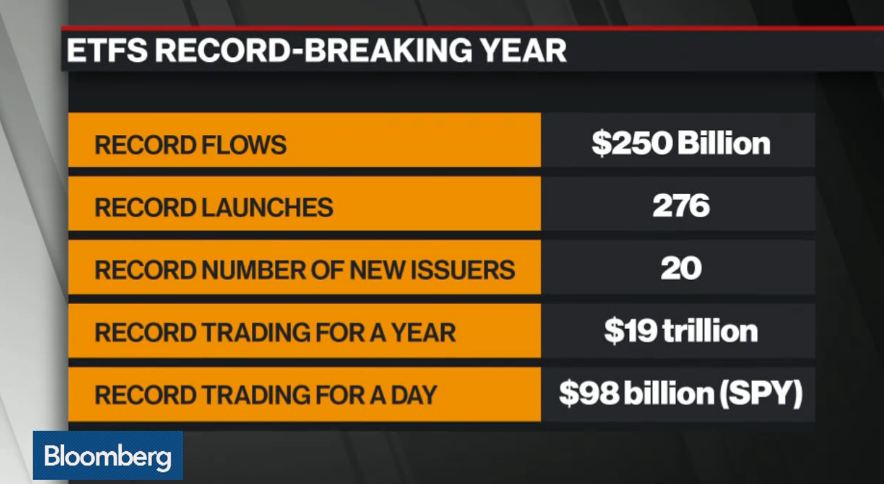

In 2017, there were over 1,000 ETFs in the U.S. alone and there were 3.42 trillion dollars worth of assets managed by ETFs around the world.

In fact, heavyweights Goldman Sachs and John Hancock were among the twenty new insurers to get in the game. ETFs can now be found for most any sector or to target a specific investment arena.

What are ETFs?

ETFs are what’s known as exchanged traded funds. They’ve been around since 1993, but saw traction about 3 years ago. They’re like index funds, except they’re commission free. Some of these have become merely trading tools, so many choose to get in on the most widely traded ones.

Is an ETF For Me?

ETFs are open for entry and exit anytime during market hours often with extremely low management fees in comparison, compared to mutual funds. There are also less fees as well, which helps investors save money by not losing their hard earned money in fees. Tracking ETFs on well-known market measures like the S&P 500 can be used for passive investing at a very low cost. The SPY was the most active ETF trading, with nearly $100 billion in one session.

4 Tips to Get Started

Almost everyone can benefit from investing in ETFs. Here are some some 4 tips for investing in ETFs:

1) Invest or Trade – Knowing your time horizon to help determine which ETF is most appropriate. A position in QQQ’s could be held long term for years while the more aggressive Ultra Pro Shares three times bull or bear funds is much more dynamic.

2) Diversify or Target – A broad market ETF can lessen individual stock risk. The theory of a sector fund is to lessen exposure to negative individual stock movements while a broad selection of companies provides opportunity. The GLD ETF (gold), on the other hand is a higher risk/reward vehicle strictly as a function of the metal itself.

3) Volume – Not all ETFs are equal. Make sure the volume and bid/ask spreads are conducive to your risk control parameters. If short term entry and exits are critical the volume needs to be adequate to buy or sell seamlessly.

4) Risk – It’s really important to understand your risk profile. Have set dollar amounts or percent that you want to risk. A disciplined plan prevents turning a trade into an investment that you hope recovers.