Savers have suffered through ultra-low interest rates for what is quickly approaching a lost decade here in the United States. Bank accounts and certificates of deposit have paid next to nothing for nest eggs.

The quest for yield has pushed money into equity markets as the best choice for money flow. The S&P 500 dividend return now outperforms the benchmark ten-year note without factoring in the stock market appreciation or decline.

That market risk factor has some investors looking elsewhere for returns.

Municipal bonds are big business with states, cities, counties, and countless other government entities to raise money to build for the public good. A nearly $4 billion dollar muni market has over 50,000 issuers to choose from according to Morningstar.

The diversity of muni’s products along with the potential tax benefits boost appeal in the current next-to-zero payout from simple saving vehicles.

Individual muni bond issuances have many factors to consider including liquidity, credit quality, maturity, and call features amongst the primary focus of payout performance.

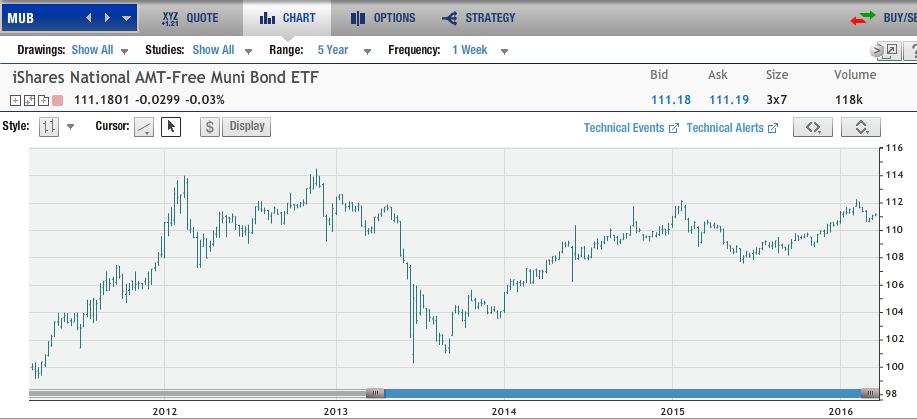

Exchange Traded Funds like MUB do their best to mimic and mirror the diverse offerings in the muni market but cannot hold all of the possible products in the portfolio.

Things to consider in a municipal ETF:

- As a benchmark – “Since its September 7, 2007, inception, MUB’s average a total return of 4.5% per year (through Feb. 29, 2016).”

- Trading volume and liquidity may be lower than other ETF markets.

- Expense ratios are typically low, starting at .25%.

- Passive versus active investing by fund management impacts performance.

- Tax implications of an ETF index may differ from the underlying assets.

Municipal bonds that are floated to finance building projects are only as good as the issuing entity. Muni’s higher return than Treasury paper is because it lacks the federal government backing of full faith and credit, for whatever that is worth.