The backspread is one of the more mysterious option strategies you can use to give you your desired exposure. While this strategy may seem confusing at first, once broken down, it’s simply the sale of a call spread with the…

The backspread is one of the more mysterious option strategies you can use to give you your desired exposure. While this strategy may seem confusing at first, once broken down, it’s simply the sale of a call spread with the…

One of the primary reasons that financial markets exist is to shift price risk. Hedging to protect positions comes in many forms. The most common price protection comes in the form of insurance. Buying a put can put in a…

Oil is everywhere…literally… oversupplied to push prices to 2009 lows back below $40 a barrel. The global glut and the inability of OPEC to cut production, intended or not to break the Shale industry, have turned sentiment on its head….

Interest Rates can’t stay near zero forever. Here are five things you should know about the interest rate hike: 1) It is coming December 16th – nothing is guaranteed, but all indications are this is a done deal. The short-term…

The most discussed and telegraphed Federal Reserve action in history has rates on the move…maybe December 16th. Five years plus of Zero rates is coming to an end according to market indicators. The conundrum for objective market watchers is whether…

Money is to be made in this merger mania if you have your chips on the right stocks. 2015 has been an epic year for takeovers as companies have cash, and low-interest rates to get more cash, to buy that…

How many times have you thought to yourself that a BIG stock move is coming and the earnings announcement is going to be the price catalyst? What if I told you there was a simple low-cost strategy with a twist…

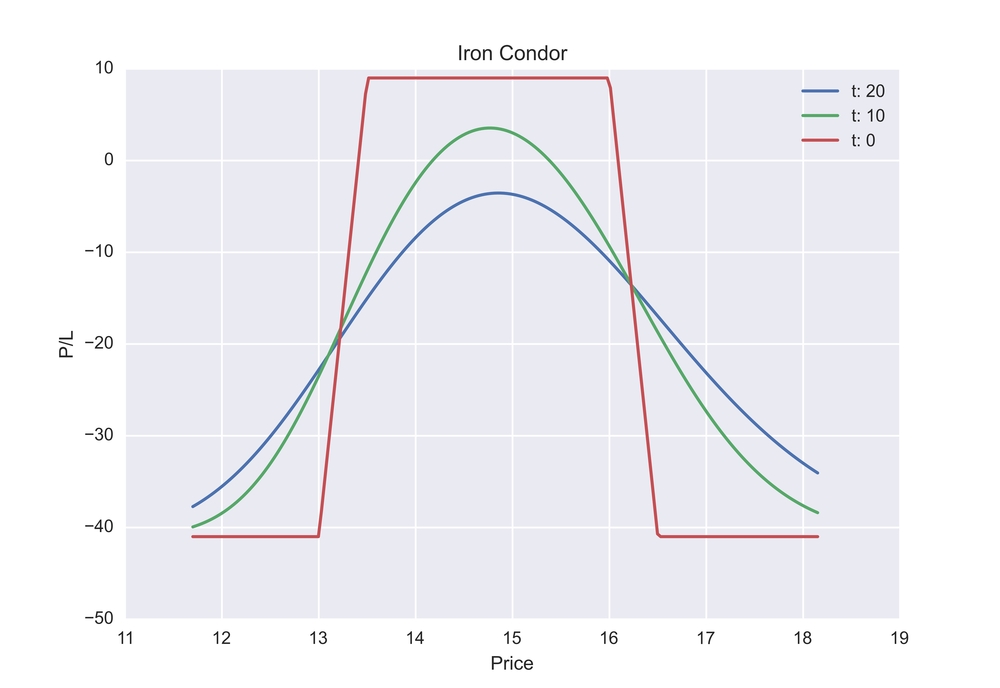

The iron condor is one of the most popular options strategies among retail investors. This 4 legged option spread gets its name from the condor bird, and is symbolic of the position’s wings. An iron condor may potentially allow one…