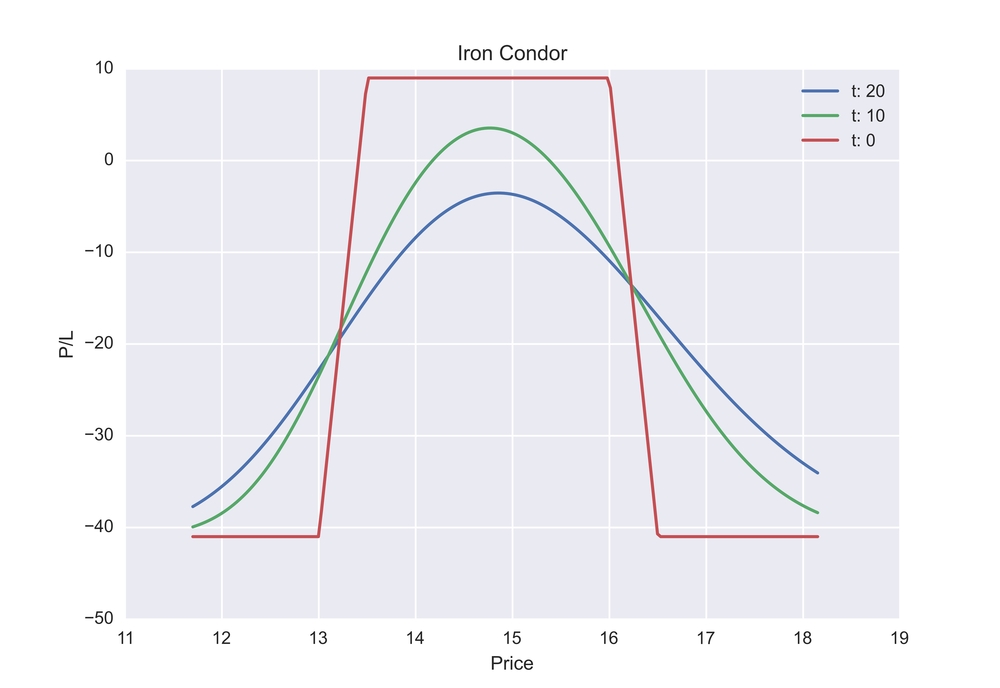

The iron condor is one of the most popular options strategies among retail investors. This 4 legged option spread gets its name from the condor bird, and is symbolic of the position’s wings.

An iron condor may potentially allow one to profit from a sideways or range-bound market. This position can also potentially profit from a decline in implied volatility.

Steps to identifying iron condor trade:

- Identify a market that has traded within a range for a period of time

- Determine if implied volatility (IV) levels are relatively high or relatively low

- Look at both call and put credit spreads outside of the trading range

- If you can sell a call spread and a put spread for a net credit that is equal to or greater than 20% of the total amount risked on the trade, an opportunity may potentially exist.

Despite being touted as a “set and forget” strategy, risk must still be managed!

Consider this: If you make $1 four times and then lose $5 on the fifth time, you are down $1.00… In other words, it is imperative to avoid taking maximum losses on an iron condor position. While these trades may potentially have a high winning percentage, heavy losses on a single trade can wipe out several winning trades.

An iron condor is simply the sale of a call spread and a put spread that are outside of an expected trading range. The size of these spreads, otherwise known as “wings” can be adjusted based on risk tolerance and profit objectives.