The medical marijuana sector is on fire!

It’s only been legal for a short period of time, but already it’s become a $7 billion market in the U.S. — and is soon expected to reach $500 billion globally.

That helps explain why investors have been pouring millions of dollars into this sector.

But here’s the thing…

Most of these folks are doing it all wrong.

Today we’re going to show you a better way to invest in this explosive market.

It’s a simple strategy that helps protect your downside while dramatically increasing your upside.

The best part is you won’t have to risk a single dime in the stock market.

Pot Stocks Are Volatile

Pot stocks can be volatile. Prices can quickly skyrocket — but they can collapse just as fast.

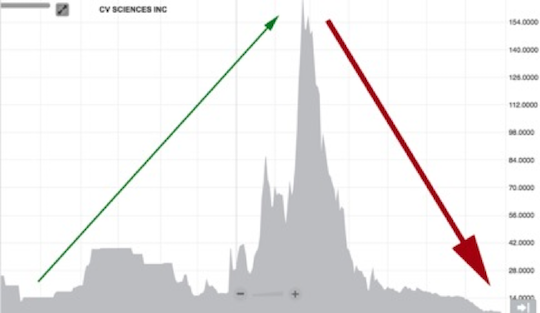

For example, take a look at CV Sciences (CVSI):

CVSI shot up from $2 to $147. Then collapsed to just 24 cents a share:

It’s the same story for 22nd Century Group (XXII).

Initially the stock skyrocketed by more than 2,500% (from 20 cents to more than $5). But then it cratered to just 61 cents:

It’s the same thing again with Mountain High Acquisitions (MYHI):

Investors who timed it perfectly could have made nearly 100 times their money — but most folks bought it near $10, right before it crashed to a penny a share!

As you can see, pot stocks can return big gains, hence their appeal. But they also come with the risk of quick losses. Timing is everything, but many people just don’t have the ability, or desire, to watch the market moves that closely day in and day out.

But there’s an alternative to all this, and it’s a great one.

You see, we recently discovered a way for investors to get access to all of the explosive upside potential of investing in penny pot stocks — with much lessrisk.

Here’s How to Lock in Your Profits

To explain what I mean, let’s take another look at CV Sciences…

CVSI shot up from $2 to $147, and then plummeted to 24 cents a share.

Investors who rode this stock all the way up and all the way down are probably sick to their stomach. Their paper profits of 7,300% just evaporated.

But now let’s look at a different group of investors.

These investors didn’t lose a dime when CVSI’s stock collapsed.

In fact, even with this stock trading at just 24 cents, they’re still sitting on a 480% profit.

How is that possible?

Simple… These investors got into CV Sciences before it went public.

They got in when CVSI was still a private startup — before it was listed on a stock exchange like the Nasdaq and before they could buy shares from their broker.

By getting in on the ground floor, they were able to lock in their shares at an extremely low price, paying just 5 cents per share.

So even with this stock trading today at just 24 cents, they’re still sitting on a triple-digit gain.

But that’s not even the best part:

The best part is if these investors had sold at the top — when CVSI was trading at $147 — they’d have earned even more:

Instead of making 73 times their money like penny stock investors could have, private investors could have earned a staggering 2,941 times their money!

That’s like turning a $100 investment into $294,100. Or a $500 investment into nearly $1.5 million!

Less Risk, More Reward

To be clear, this isn’t an isolated example.

In the private markets, you’ll see gains like this again and again.

Look at 22nd Century, which we mentioned earlier.

Even if private investors had sold their shares at the stock’s low of about 61 cents, they still would have made nearly 500% on their money!

At its peak of about $5 per share, they’d have earned a profit of 4,000%.

I could show you dozens of other examples, but you get the point: Not only does investing in private startups put you in position to protect your downside, but it also helps you maximize your upside.

*Post originally appeared in Daily Reckoning