Spread trading can be performed in numerous ways. While an options call spread or put spread may be the first method that comes to mind, spread trading can also be performed using different instruments or different contract months on the same instrument.

A futures spread is simply a spread between two different futures contracts. There are several types of futures spreads that may be utilized. These include:

- Intra-commodity spreads – Futures contracts that are spread using the same underlying instrument. An example of this is long March corn and short December corn.

- Inter-commodity spreads – Futures contracts that are spread between two or more different markets. Examples include long Kansas City wheat and short Chicago wheat, or short 30 year bonds and long 10 year notes.

- Calendar spreads – Futures contracts that are bought and sold using the same underlying instrument but different contract months. A calendar spread is a type of intra-commodity spread. An example of this is long January crude oil and short May Crude oil

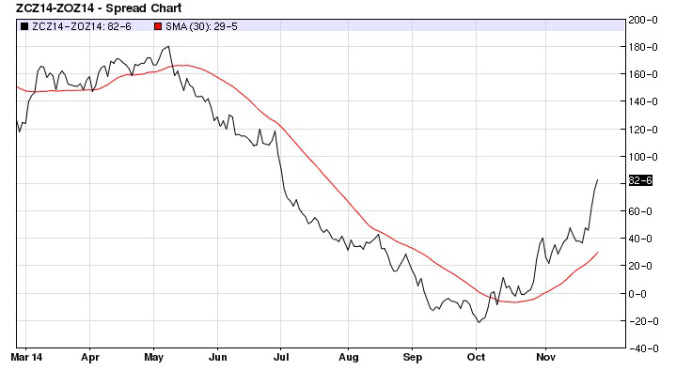

Spreads may be viewed in chart form online and on trading platforms. The chart below is a spread chart for December 2014 corn futures versus December 2014 Oat futures:

Many traders prefer to trade futures spreads over outright long or short positions in the underlying. There are several reasons for this including:

- The possibility of less overall position volatility

- Lower margin requirements

- The ability to trade larger size

- The ability to attempt to take advantage of a market in contango or backwardation

- The potential to take advantage of seasonal tendencies

It should be made very clear, however, that spread trading involves as much risk as trading outright futures contracts. While spreads may offer some potential advantage such as those listed above, spreads can also expand or contract quickly. In addition, it may not be possible to enter a stop-loss order on a spread.

The key to keep in mind is that spread trading is focusing on the relationship between two contracts, and not simply whether a market goes up or down.

Futures trading involves substantial risk of loss and is not suitable for all investors. Make sure you are aware of the risks before using any strategy.