Options have many advantages, including reducing cost and risk while potentially increasing investment return. But how do you know the best strategy to use for your needs?

Lucky for you, there’s a simple way to help you objectively contemplate and compare disciplined trading candidates.

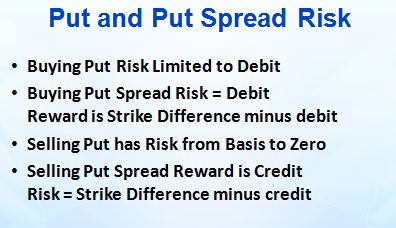

Quantifying and controlling trade risk needs to be a primary focus. This is what separates the pros from the novice investors with those in the know prepared for being wrong.

Here’s a quick cheat sheet to help you out with that:

After trade risk is analyzed, you need to know the expiration break even level so you can better understand expectations.

Knowing where you need price to be at expiration for profitability is invaluable in the decision making process.

Each option strategy has its own positives and negatives. There is no “best” tactic but rather choices to be made.

Choosing an individual option play is much easier when you can quickly calculate trade risk and break even.