Delta can be the carburetor for option positions. In the money options, at least those with real intrinsic value, have more fuel to produce power compared to out of the money getting just fumes.

You have two choices:

ITM (in the money) – when the strike in below stock price for a call and above for a put

OTM (out of the money) – when the strike price is above the stock price for a call and below for a put

Need an example? The performance of the 77 Delta option compared to a 17 Delta is equivalent to a street rod against a pedal cart.

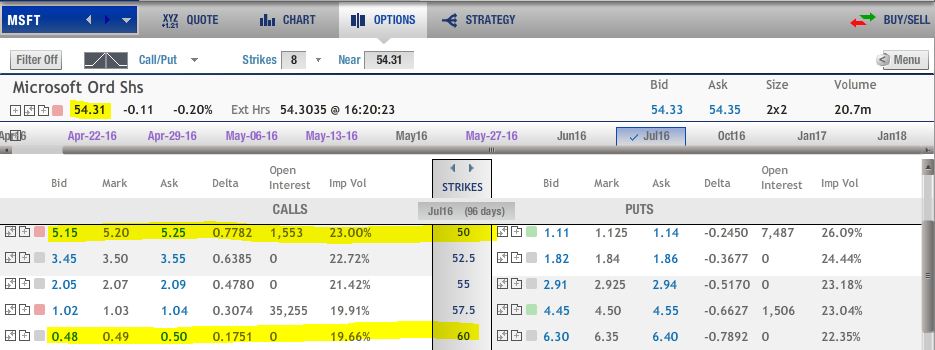

This is with Microsoft trading at $54.25:

- An MSFT $50 call has $4.25 in real value and a Delta of 77 for $5.25.

- An MSFT $60 call has ZERO in real value and a Delta of 17 for $0.50.

The high delta option outperforms almost every time and most importantly can profit significantly on only a modest market move. If out of the money is at expiration, the option expires worthless.

The out of the money options need a big move to be profitable at expiration. More times than not, they go off the board as just long-shot gambles.

Another aspect of the delta often goes unappreciated or ignored. It can be used to approximate the probability of a position.

That delta can in rough terms illustrate the mathematical chance that the option will be in the money at expiration.

Simply put, a higher delta means a better chance that the option will be in the money. It doesn’t tell how you far, but can be used to choose high probability plays.

Long-term success is about consistency achieved through repeated high probability events. Eliminating the gambling mentality by selecting high delta option buys can dramatically reduce equity swings and put the odds in your favor.

Delta is more than just performance payoff; it’s probability.