Buying options is different than buying the underlying asset, because not only do you have to be right on the underlying market direction, but you also have to consider other factors, such as time decay, volatility levels and several other factors that can cause you to be 100% accurate on direction of the underlying asset, and still end up losing the entire premium paid.

When it comes to buying options, there are several pitfalls that can be avoided by following some simple trading tips that I’ve outlined below. While there are no guarantees when it comes to buying options, I can promise you that each these trading tips are based on over 20 years of actual trading, running two hedge funds and mentoring thousands of traders over the years.

Trade In The Direction Of The Major Trend

It’s very tempting as well as less difficult psychologically to trade against the trend. People are naturally conditioned to buy low and sell high, so it’s very difficult for some to change their belief system when it comes to financial markets.

It’s very tempting as well as less difficult psychologically to trade against the trend. People are naturally conditioned to buy low and sell high, so it’s very difficult for some to change their belief system when it comes to financial markets.

I’ve back tested numerous trading methods over the past two decades and trading in the direction of the overall trend lowers your risk, increases size of gains and percentage of profitability.

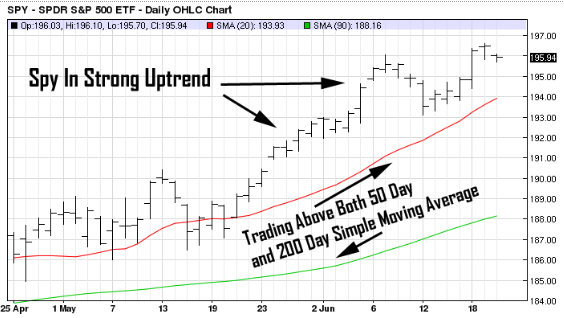

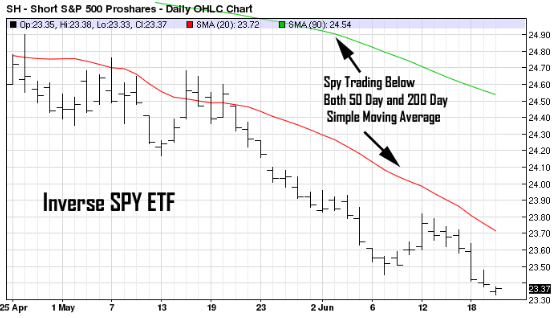

To determine whether or not the underlying asset is trading in an uptrend, simply confirm that the underlying asset is trading above both the 200 day and 50 day simple moving average.

To confirm that the underlying asset is trading in a strong downtrend, the underlying asset must trade below both the 200 day as well as the 50 day simple moving average.

Don’t Use Stops And Market Orders

The only type of order you want to utilize when buying options is a limit order. Market orders will cause you incur unnecessary slippage, because the spread between the bid and offer can be rather wide with the majority of options contracts.

The only type of order you want to utilize when buying options is a limit order. Market orders will cause you incur unnecessary slippage, because the spread between the bid and offer can be rather wide with the majority of options contracts.

Stop orders can be equally as bad because once the stop gets executed, the order becomes a market order, which opens you up to terrible slippage over time.

Often times I see traders using stop limit orders; this type of order becomes a limit order after the stop is triggered, so there’s no guarantee that you will get filled on the trade. If you do decide to experiment with stop limit orders, avoid using them for risk protection, since you may or may not be filled; something you don’t want to chance when it comes to risk control.

Avoid Information Overload

One of the most important characteristics of successful trading is having confidence in your strategy in good times and in bad times. Recently, I spoke with a trader who followed twelve different advisory services. While the trader was knowledgeable, he sounded confused and never knew with certainty if he should be buying or selling.

One of the most important characteristics of successful trading is having confidence in your strategy in good times and in bad times. Recently, I spoke with a trader who followed twelve different advisory services. While the trader was knowledgeable, he sounded confused and never knew with certainty if he should be buying or selling.

While I encourage everyone to learn as much as possible about options trading, following more than one or two advisory services will only confuse you and undermine your confidence in your own belief system; which is crucial to a long term trading success.

Use Time Stops Instead Of Stop Loss Orders

One of the main differences between the underlying asset and the option is time value. With stocks, ETF’s and bonds, time is not a factor; in other words, the length of time you hold the position has no impact on the price of that position.

One of the main differences between the underlying asset and the option is time value. With stocks, ETF’s and bonds, time is not a factor; in other words, the length of time you hold the position has no impact on the price of that position.

Since options are derivatives, they are subject to time decay, which is beneficial for the seller of the option and detrimental for the buyer, since each day the option loses value due to time decay.

Not realistically taking into account the length of time you intend to stay in the position is equivalent to trading the underlying asset and not using stop loss orders to protect against unforeseeable risk of loss.

With options, I always make sure to give each trade a maximum holding time period. Unless you do so, you will find that you end up holding the position till expiration or till it makes no sense to liquidate it. Setting guidelines for how long you intend to hold the long options position will force you to cut your losers quicker.

Monitor VIX Level Daily

If you trade stocks, ETF’s or index options, you need to know and follow the VIX index very closely. The VIX is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices.

Most stocks and ETF’s have a high correlation to the overall market, so in addition to comparing the implied volatility level of each stock or ETF that you trade, you should also examine the volatility of the overall market, since it will have a major impact on the price of the option that you are trading.

Know The Option’s Delta Ahead Of Time

The option’s delta is the rate of change of the price of the option with respect to its underlying assets price. If a call option has a delta of $0.25, the option will move about $.25 given a $1 move, up or down, in the underlying

The Delta can range from 0 to 1.00 for calls and 0 and -1.00 for puts and tends to be increase as the options strike price gets closer to being in the money and moves further away as the option gets further out of the money.

Buying options with low Delta will cause the options sensitivity to be extremely low in comparison to the movement in the underlying asset.

Therefore, I recommend you purchase options that have a minimum Delta of .50 for call options and -.50 for put options. This way you will assured that the option that you purchased will gain at least $.50 for every $1.00 move in the underlying asset.

Implied Volatility Levels Must Be Low

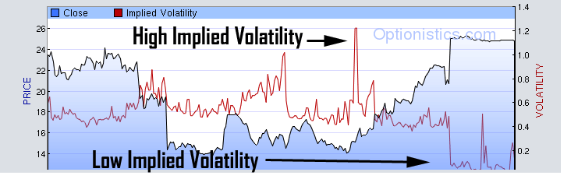

Implied volatility represents the expected volatility of the underlying asset and is directly influenced by the market’s expectation of the underlying assets degree of movement as well as direction. Options that have high levels of implied volatility will result in expensive option premiums.

Conversely, as demand for an option diminishes, implied volatility will decrease. Options containing lower levels of implied volatility will result in cheaper option prices, which makes them ideal for buyers. Options that are trading further from the strike price and are out of the money, tend to be influenced by implied volatility more than options that have high intrinsic value, because implied volatility only influences the time value component of the option.

Always check the implied volatility level on the underlying asset before purchasing options, because if implied volatility levels on the underlying asset are high, the odds are strong that the options will be expensive and if implied volatility on the underlying asset is low, you will find that the options are priced lower.

Most options brokers offer software that will help you track the underlying assets implied volatility level. I recommend you only buy options when the implied volatility level is in the lower 30th percentile of the annual range and avoid buying options when implied volatility moves relatively higher.

In conclusion, by following these simple trading tips, you will avoid common mistakes that can make a big difference in your options trading.

All the best,

Roger Scott

Market Geeks