Swing Trading Options Strategies

Over the last few months, I’ve received several emails asking me questions about Swing Trading Options Strategies and how to apply our trading strategies to the options market. Originally, I decided against discussing options because I wanted to focus extensively on swing trading and day trading Stocks, Futures and Currencies.

I figured this was more than enough for most people to start learning about the markets and I ALWAYS tell my students to stay away from swing trading options strategies till they have a good handle on making money with actual assets before moving on to trading derivatives.

My Take On Swing Trading Options Strategies

When I started trading back in the early nighties, my progression was Stocks, Commodities, Index Futures, Stock Options, Forex. By the time I started trading options I already knew enough about the markets and more importantly about risk to make reasonably good trading decisions. But looking back, if I started trading options instead of other markets, I doubt I would have developed the necessary foundation and discipline to succeed with options.

Options Volatility Is the Key To Success

One of the biggest reasons why beginners run into trouble when they first start swing trading options strategies is because they lack the basic understanding of implied volatility and how implied volatility can impact and distort the price of options. Did you know that options can increase and decrease in value based on simple perception and nothing more? Did you know that at one point that during the stock market crash of the 87, BOTH the calls and the puts increased in value several times over, simply because of the fear that investors brought into the marketplace?

Yes, with options the most important factor is not market direction, but future perception of price or implied volatility which shows the market’s opinion of the stock’s potential moves, or the markets expectation of the future. I can spend the next 2 hours explaining to you the technical definition of implied volatility and options pricing. I used to be obsessed with the Black-Scholes model and probability calculations and I’m going to share a little story with you.

This had a major impact on my swing trading options strategies and how I constructed my strategies after this unfortunate event occurred.

My Personal Options Trading Story

I remember the first time I read Options As A Strategic Investment (the bible on options trading) the book was over 800 pages and I remember reading every page and thinking that the more I learn about implied volatility and all the different strategies, the more profitable I was going to become.

I remember understanding that if you sell options that have high volatility then in the long run you will make money, because statistically options will go to fair value so over time you will make money by selling expensive options and buying them back when volatility is low. This made sense to me because I naturally think in terms of probability and this was nothing more than getting something expensive and getting rid of it when it was cheap.

Anyway, I got very excited and rushed out to get the next morning’s Investor’s Business Daily at the news stand (there was no internet and the next day’s paper came at 8 pm the night before). I remember the newspaper had an options table that made it very easy to get all the options prices that were traded that day. This would give me at least some idea of what to look for and what cheap or expensive volatility wise.

I ended up picking about 5 stocks and they were all tech stocks and the volatility on them was extremely high, I mean these suckers were priced two to three times what other options were priced at with similar risk and strike price. I thought I was really getting lucky here and the next morning I ended up selling about $5,000 worth of premium that had about 3 weeks to go before expiration.

I Thought I Discovered the Options Trading Holy Grail

I thought I did really well and couldn’t believe my luck, I thought I found the Gold at the end of the rainbow, but naturally and anyone who’s ever sold option premium will tell you that time begins to move very slow when you are selling options. If time in your life is going by too fast, I suggest you sell a few premiums and all of a sudden weeks will go by like months.

Getting back to my story, within the next 4 to 5 days, each and every one of the options that I sold increased in price dramatically. One stock got bought out, the other stock had incredible earnings and the others just took off. This is when I figured out something very important and I want you to understand it without losing your shirt. When options are overly expensive, there is typically a very strong underlying reason for this, just like when you go to the racetrack and the best horses payout 2 to 1 while the horses that are less likely to win have odds of 10 to 20 to 1, there’s a reason for this and typically it’s right on the money.

My reason for telling you this story is because I don’t want you to get too caught up in the GREEKS because they never helped me make one penny trading options. All those software programs that tell you which option is expensive or which option is cheap are great, but the problem is they don’t tell you WHY the option is cheap or why it’s expensive and if the option has a pulse or any type of volume to it, it will typically be priced high or low because of an underlying reason and this is something the GREEKS will never tell you and this has much more impact on the options price than any mathematical or statistical calculation ever will.

Swing Trading Options Strategy That Works

Now that you understand a bit about how options are really priced, I will share a great swing trading options strategy with you that you can apply right away to most financial markets. This strategy takes implied volatility into account, so you will be buying both calls and puts when they are cheap or when implied volatility is on your side.

As most of you know, I’m not a counter trend trader, this means I always follow the trend and try not to pick market tops or bottoms, but when you are trading options, trading in the direction of the trend means buying options at expensive prices and offsetting them when they are more expensive, one way to combat implied volatility is to use a counter trend method. I typically don’t use counter trend methods with assets, but in this case we are not trading assets we are trading derivatives of those assets, so we have to trade a bit differently.

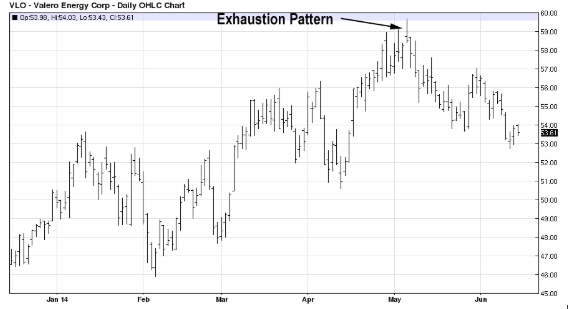

One of my favorite methods to time my purchases is to use market exhaustion patterns. What we want to see is an exhaustion or if there is no gap, at least a bar with a lot of range that opens in one direction and closes in another direction. You will usually find about twice or three times per year on most large cap stocks that are not trending strongly.

Buy Puts When Premium Is Low

In this example Valero Energy, a large cap stock goes through a reversal when most traders are expecting further upside movement. This is when volatility to the upside is really high. If you were to buy a call option at this price level, I doubt you would make money even if the stock would for about 4 to 5 points. The stock would really have to move up strongly for call options to keep gaining, unless the mom

entum would slow down and the volatility would decrease. A smart trader would buy PUT options when the stock begins breaking down. The put options would have so little volatility that even if the market went against you for a day or two, the option wouldn’t volatility would be so low that the options price would most likely not decrease too much.

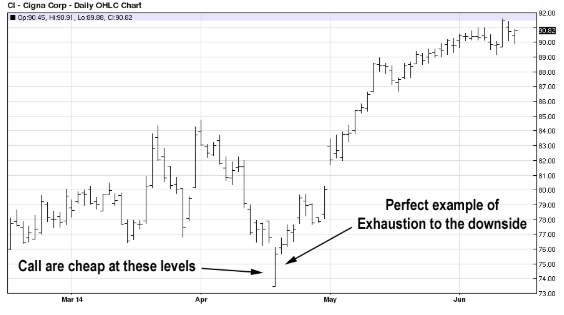

Buying Calls When Premium is Cheap

In this example we have a near perfect example of a exhaustion pattern to the downside. When this day happened, the put options were grossly overpriced, so much that if you were to buy a put he day before the big drop, you would barely see any increase in price. But if you bought a CALL option around the time the market bottomed out and even if you were off by a few points, the volatility would be so low on the option that it would barely go against you.

Keep Swing Trading Options Strategies Simple

I hope this gave you some ideas about your own options trading and how to put together working swing trading options strategies. Always remember that implied volatility is not something you can ignore and it can take on a life of its own and distort the true value of your options contract. Yes, the market may be going up and your option may be decreasing in value because the market’s perception of the future is not as optimistic as it was two days earlier!

All the best,

Roger Scott

Market Geeks