Renowned investor Warren Buffet has the luxury of nearly infinite amounts of money and time to wait until his investments are profitable. This value approach largely eliminates emotional position exits with the confidence and conviction to be patient.

The longer the time window, the greater chance that positive things will happen. Eventually, the proverbial monkeys will type that novel if given enough time.

Novice option traders often learn about time decay the hard way, with the ice cube melting in their hands and the long position eventually expiring worthless.

Not anymore. Here are two rules you need to know when buying options:

- Buy In-The-Money options that have high probability – A $50 call strike trading at $6 when the stock is at $55, has only $1 in time value. Unfortunately, the inexpensive Out-Of-The-Money $60 call option that new option traders approach because they are cheap is all time and subject to sharp decay as it approaches expiration.

- Buy more time than you need – The dollar differential in a one-month option versus a three-month option is negligible.

When volatility levels are reasonable, a six-month option can be a great value when compared to a three-month position. The extra $50 or $100 is often well worth it just in case development doesn’t occur in the short term.

Remember, always compare premiums and look to buy more time than you need whenever possible. Look at deferred months to find the best value.

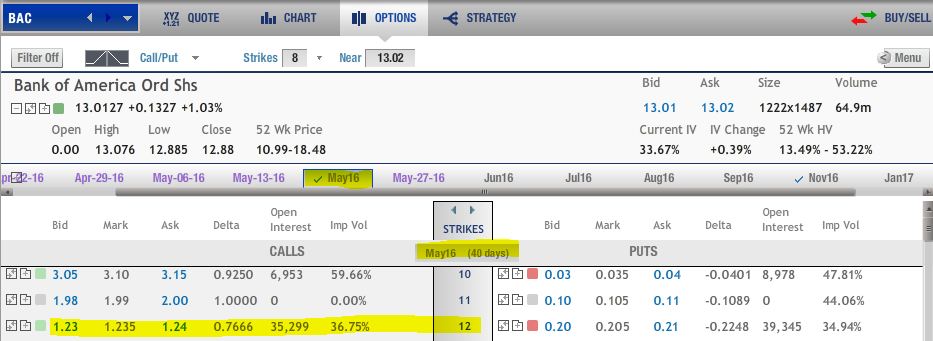

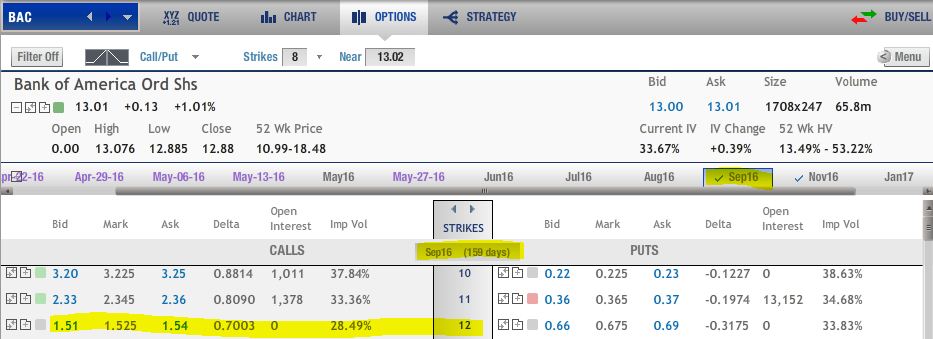

The Bank Of America $12 call in May with 40 days was $1.25, versus the July 96 days for $1.45, versus the September 160 days for $1.55. The cost of the additional time is negligible, literally $30 for an extra four months.

Buy enough time to be right. A least you have it, even if you may not need it.