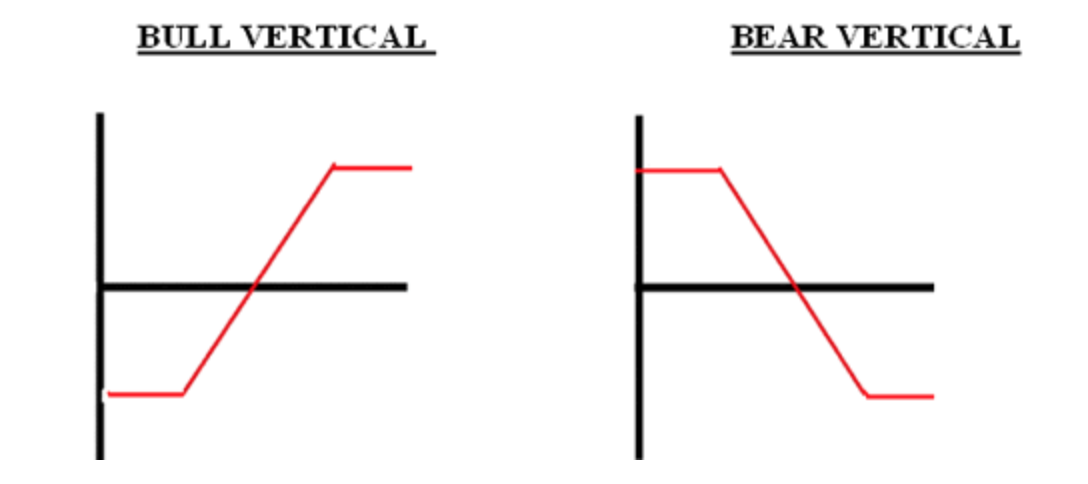

Vertical options spreads are very powerful trading tools if used correctly. There’s a total of four different vertical spreads and each one has its own unique purpose.

The four different spreads can be divided into two different categories, debit spreads and credit spreads. It’s very simple to differentiate between the two because of their names.

With vertical credit spreads premium is collected, by selling an option that’s more expensive than the option purchased. The goal when initiating credit spreads is for time to run out so that the premium that you collected when the trade was initiated would be yours to keep.

With vertical debit spreads you buy the expensive option and sell the cheaper one. The profit with debit spreads is realized if the underlying asset moves in the right direction, before the options expire.

While all of this may sound confusing to you, after I go through the four different types of vertical spreads and demonstrate a few examples, you should have a very good understanding of the differences and the similarities between them and begin to gain insight into which type of market conditions will yield the best result with each of the different types of vertical spreads both credit and debit.

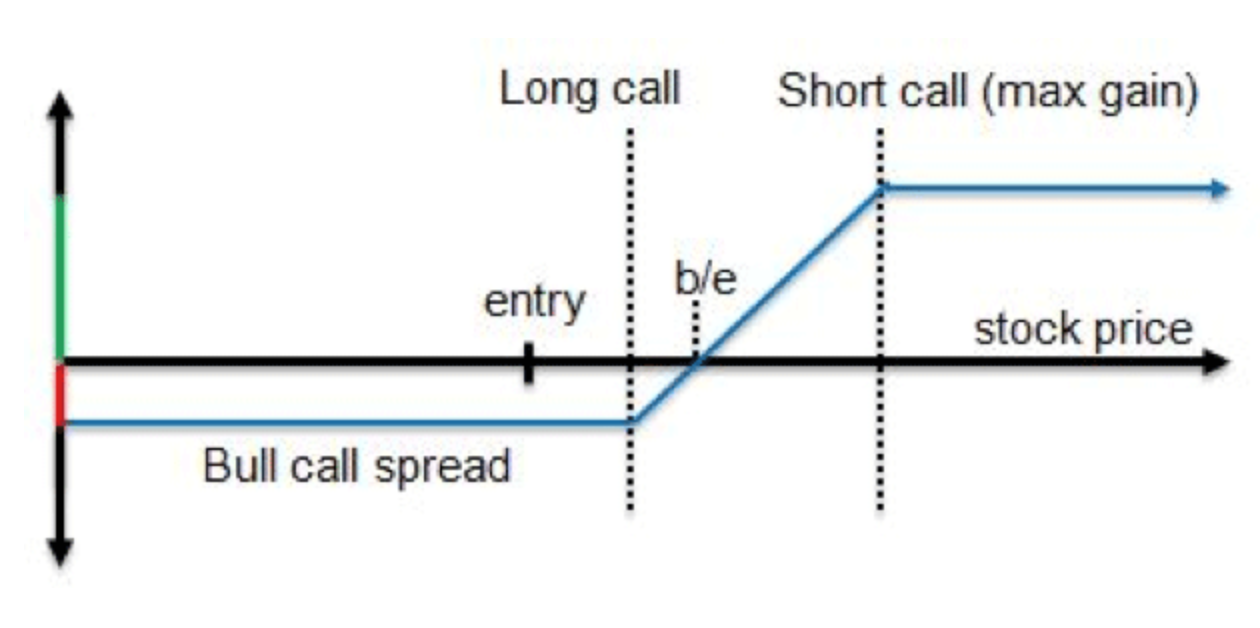

Vertical Call Debit Spread

The bull call spread as it’s commonly called is an options strategy that works well when the trader is expecting a moderate price increase in the underlying asset to the upside. To initiate the vertical call spread the trader would need to purchase a call option and simultaneously sell a higher strike price call option on the same asset with the same expiration month.

By selling or shorting the further out or the higher strike price call option, the trades limits the profit potential on the trade in exchange for reducing the cost as well as the risk on the trade.

Limited Upside Profits

The maximum profit potential is reached when the underlying asset trades above the strike price of the option that was sold and the gain is calculated as the difference between the strike price of the option that was purchased and the one that was sold minus the initial debit that was paid to enter the spread.

The maximum risk on the trade is known at the time the trade is initiated and is limited to the cost of the call that was purchased minus the offset of the cheaper cost that was sold at a credit.

In case you are wondering, the break even point on the bull call spread or the call debit spread occurs when the price of the asset moves above the strike price of the option that you purchased by the amount you paid out of pocket to initiate the spread or the net premium paid.

Example of Vertical Call Debit Spread

ABC stock is currently trading at $50.00 and trader believes that the price is going to move to the $60.00 price level within the next 4 months. The traders purchases a $50.00 strike price call option for $10.00 and at the same time sells the $60.00 call option for $5.00. The option that was sold expires at the same time as the option that was purchased.

If ABC stock moves up the the $60.00 strike price level at the time the options expire, the spread will reach maximum profit potential, since the option that was purchased will reach maximum possible value and the option that was purchased would expire worthless. If on the other hand the stock rallied up to $70.00, your gain on the spread would be limited because you sold the $60.00 strike price call option. So regardless of how much ABC gains between the time you initiated the spread and expiration, the maximum profit on the spread would be reached at the time ABC reaches $60.00 per share. If you sold a higher strike price call option, the profit potential on the trade would be limited to the strike price of the option that was sold.

If ABC stock plummeted to $40.00 at the time the time of expiration, both options would expire worthless and your maximum loss on the trade would be realized. Keep in mind that the maximum loss is known at the time the debit call spread is initiated and the maximum profit is also known at that time since it’s the difference between the two strike prices minus the out of pocket cost you paid when initiating the spread.

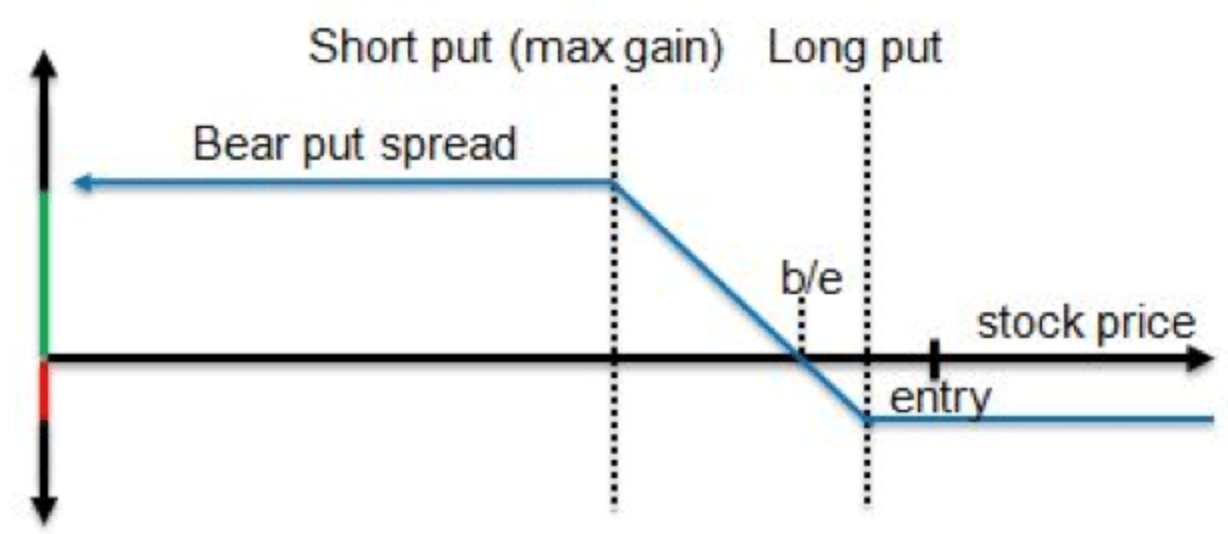

Vertical Put Debit Spread

The other vertical debit spread is the bear put spread, this spread is initiated when the trader believes the underlying asset is going to move lower moderately. The spread is constructed by purchasing a put that’s closer the current market price and selling a lower strike price put, one with a cheaper price. The put that’s sold partially pays or offsets the cost for the put that was purchased and both puts must have the same strike price, otherwise the spread is not a vertical.

The maximum profit potential that can be gained on the put debit spread is the difference between the strike price of the put that was purchased and the one that was sold to offset some of the cost from the put that you purchased. The maximum loss on the put debit spread is the amount that was paid for the expensive put minus the offset from the cheaper one.

One of the major benefits of trading vertical spreads is the benefit of knowing the maximum risk and the reward on the trade at the time the trade is initiated.

The break even point on the debit put spread or the bear put spread as it is commonly called, occurs when the price of the asset moves below the strike price of the option that you purchased by the amount you paid out of pocket to initiate the spread or the net premium paid.

Example of Put Debit Spread

ZYZ stock is trading at $50.00 and you believe that it’s going to move to the $35.00 level within the next few weeks. You purchase the $50.00 strike price put option for $5.00 and you sell the $40.00 strike price put option for $2.50, for a total out of pocket cost of $2.50. Both options expire in 8 weeks giving you plenty of time to take advantage of the potential downside movement.

If at the time the option expires, the underlying stock trades at $40.00, the trader will realize maximum profit on the trade, while the put option that was sold will expire worthless. If ZYZ stock moved lower to the $35.00 level at the time the options expired, the profit potential would be the same, because the profit is limited to the strike price of the put that was sold. In this case the strike price of the put that was sold was $40.00, so regardless of how much lower the stock trades below the $40.00 level, the profit will be limited to the strike price of the option that was sold and in this case the profit is limited to the $40.00 strike price put option.

In on the other hand ZYZ stock rallied to the $60.00 price level, the traders loss would be limited to the price the trader paid for the $50.00 strike price put minus what he received for the sale of the $40.00, so in this case the loss would be limited to $2.50, regardless of how much higher the stock rallied before the options expired. That’s the benefit of vertical spreads, your risk is limited and known ahead of time.

Vertical Credit Spreads

The next type of vertical spread I want to cover is the vertical credit spread. With credit spreads, the ultimate goal is to keep as much of the premium as possible instead of speculating on market direction. The ideal environment for the credit spread seller is for the underlying asset to move lower or stay at the current price level without moving higher; so that the option that was sold can expire and the premium that was collected can be kept without any type of obligation on the part of the seller.

There are two different types of credit spreads, one constructed with calls and the other using puts. First I will go over the vertical call credit spread; commonly referred to as a bear call spread.

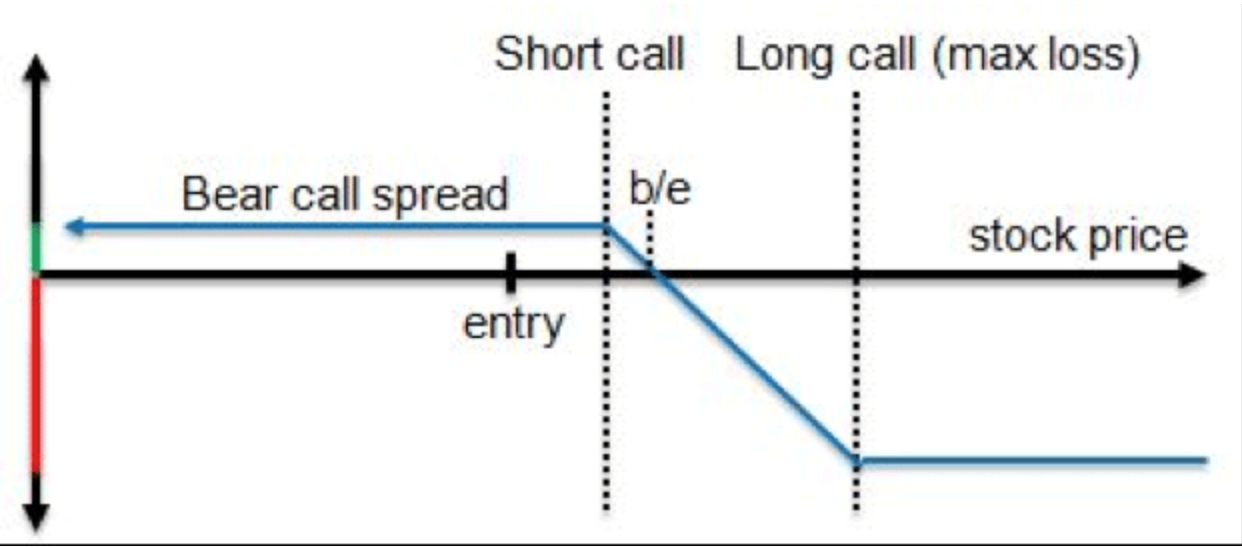

Bear Call Spread

The vertical call credit spread is assembled by selling an option that is at the money or close to the money and simultaneously purchasing an out of the money call with a higher strike price. The purpose of selling the call is to ultimately end up keeping the premium that the seller received from the buyer and the only benefit of buying the higher strike price call is for the seller to maintain some type of insurance policy or a hedge, in those cases when the underlying asset moves higher unexpectedly and causes the call that was sold to inflate substantially in value.

By purchasing the higher strike price call option the seller limits risk on the call option that was sold to the difference between the strike prices of the option that was sold and the option that was purchased for the purpose of mitigating risk.

The maximum profit potential on the credit call spread occurs if the underlying asset stays below or at the strike price of the call option that was sold and maximum loss on the trade occurs if the underlying asset trades up to or above the strike price of the option that was purchased. The loss can never exceed the difference between the two strike prices (minus the net premium received) regardless of how much the underlying asset moves higher, since the option that was purchased will always increase in proportion to the option that was sold; assuming both options eventually end up in the money because the underlying asset traded substantially higher after the credit call spread was initiated.

The break even on the bear call spread occurs if the underlying asset trades at expiration above the strike price of the option that was sold by the amount of the net credit received when opening the position.

Example of Bear Call Spread

ABC stock is trading at $65.00 and over the past few months has been moving lower gradually and you believe that this price action is going to continue over the next several weeks. You sell a call option with a strike price of $65 that expires in 4 weeks for $6.00 and in case ABC stock moves higher, you purchase the $75 strike price call option for $2.00. The maximum profit that you can make on this spread is the net premium that was received when the position was initiated, which was $6.00 minus the $2.00 debit that was spent on the $75 call for protection.

If ABC stock stays below $65.00 till expiration, the spread seller will keep the premium since both options will expire worthless. If on the other hand the underlying asset trades above $65; the spread seller will begin losing on the spread.

Maximum loss will occur if ABC stock trades at or above $75 because at that price level, the call option that you purchased will begin to offset risk created by the $65 call option; in case ABC stock continues moving higher above the $75 dollar level.

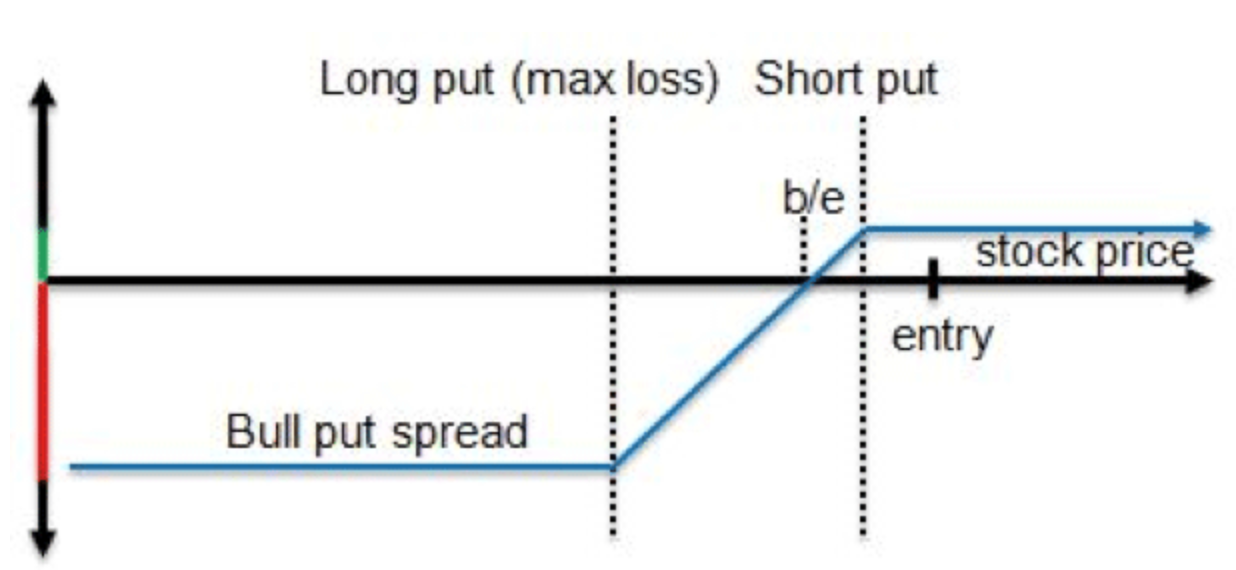

Bull Put Spread

The vertical put spread or bull put spread is created by selling the at the money or slightly out of the money put option and at the same time purchasing a cheaper or lower strike price put option. The spread is vertical because both options expire on the same day. Since the put bull spread is a credit spread, the end goal is to capture as much of the premium as possible between the time the spread is initiated and the time both options expire.

Upon expiration, the trader would keep the premium that was received for selling the more expensive put option out of the two and the cheaper put option is purchased for protection; in case the underlying asset moves sharply lower after the spread is initiated. The small debit that must be paid for the cheaper put option is worth the cost, since an unexpected move lower can wipe out several profitable trades.

Maximum profit on the vertical bull put spread is realized if the underlying asset continues to trade at or above the strike price of the put option that was sold prior to the options expiration date. Maximum loss on the vertical put bull spread occurs if the underlying asset trades trades at or below the strike price of the put option that was purchased. If the underlying asset trades below the strike price of the put option that was purchased, the loss will still be limited to the strike price of the option that was purchased, so maximum exposure or downside for the spread is the difference between the two strike prices minus the net premium that was received for selling the expensive put minus the offset for the put that was purchased.

The break even on the bull put spread occurs if the underlying asset trades on expiration date below the strike price of the option that was sold by the amount of the net credit received when opening the position.

Example of Bull Put Spread

ZYZ stock is trading at $75.00 and over the past few months has been moving higher gradually and you believe that this price action is going to continue over the next several weeks. You sell a put option with a strike price of $75 that expires in 4 weeks for $8.00 and in case ZYZ stock moves lower, you purchase the $65 strike price put option for $4.00. The maximum profit that you can earn on this spread is the net premium that was received when the position was initiated, which was $8.00 minus the $4.00 debit that was spent on the $65 put for protection.

If ZYZ stock stays above $75.00 till expiration, the spread seller will keep the premium since both options will expire worthless. If on the other hand the underlying asset trades below $75; the spread seller will begin losing on the spread.

Maximum loss is the difference between the strike price of the option that was purchased and one that was sold. Therefore, regardless of how low the underlying asset moves prior to the time the option expires, your risk will always be limited to the difference between the two strike prices.

Vertical spreads remain some of the most frequently traded options spreads. The risk and reward is simple to calculate and your maximum loss is known at the time the spread is initiated.

Keep In Mind

I hope this tutorial clarified the difference between the four different types of vertical spreads. Keep in mind that only time and experience can help you decide between a net position and a spread. In case of collecting premium, there’s rarely a time when selling net premium works out better in the long run than credit spreads.

I hope this tutorial clarified the difference between the four different types of vertical spreads. Keep in mind that only time and experience can help you decide between a net position and a spread. In case of collecting premium, there’s rarely a time when selling net premium works out better in the long run than credit spreads.

When it comes to debit spreads, always consider the type of move you are expecting. If you believe the underlying asset is going to rally strongly, a net position would probably work best, but if you are anticipating a mild price swing, then a debit spread may be a better alternative.

Wishing you the best,

Roger Scott

Head Trader

Options Geeks