On December 31, 2015, the SPDR S&P 500 Trust ETF (SPY) closed at $203.87. Ten years earlier, on December 31, 2005, the SPY closed at $124.51.

Price appreciation over this time-frame was 63% (5.00% annualized). An investor who held on to his SPY holdings would have also been paid dividends every quarter starting out with $0.52 and eventually climbing to $1.21 – a nice bit of income.

Did you know that if the investor had reinvested those dividends into additional shares of the SPY, his total return over the ten years would have been 100% (7.2% annualized)? And he would have achieved this without investing another dime!

This is the power of the compounding of reinvested dividends! Every investor seeking long-term growth needs to be aware of this mathematical miracle. We have been shown the benefits of investing on a regular basis, i.e. dollar-cost-averaging, but too many do not reinvest the dividends paid out by their stocks and mutual funds (including fixed-income funds).

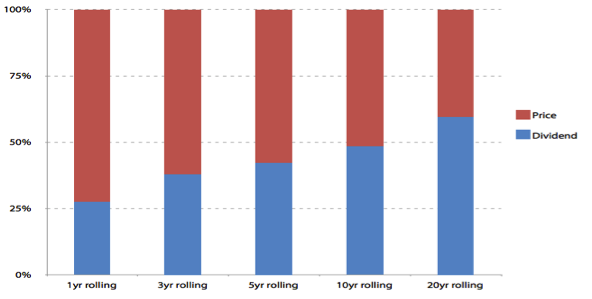

A Morgan, Stanley study of January 2013 discovered that from 1930 – 2012, only 56% of the return of the S&P 500 index was from price appreciation. If you need more convincing, check out the graph below:

The proportion of S&P500 total returns due to price and dividends analyzed over different moving average periods, i.e. the average over a given period of time from December 31, 1940, to December 31, 2011.

Source: Bloomberg, Guinness Atkinson Asset Management

It works with individual stocks, too. Take ALTRIA (MO) for example. Price appreciation, including splits, for the ten years ending December 31, 2015, was 12.88% compounded annually – the stock rose from $17.29 to $58.21, growing a $10,000 investment to $33,660.

Throw in dividend reinvestment, which by the way rose over the time span, and the $10,000 grew to $58,259 – raising the annual return to 19.31%. Even a stock like Exxon-Mobil (XOM) which was only able to muster a 3.33% annual return from price appreciation alone, gave stockholders a 5.87% annual return if they reinvested their dividends.

The evidence is clear – if you don’t need to spend them, reinvest your dividends.