A lot has been said about the importance of staying invested over the long-term. Analysts and advisors routinely encourage investors to avoid getting caught up in the short-term volatility of the markets. They cite studies that show the high impact on returns if you miss the best days in the markets.

However, this analysis keeps the focus solely on returns. To me, its flaw is that it includes being invested during the worst days! Is it not important for investors and traders to have a complete picture? Is it more important to maximize returns or minimize risks? This shortcut should help investors and traders approach their personal answer to this question.

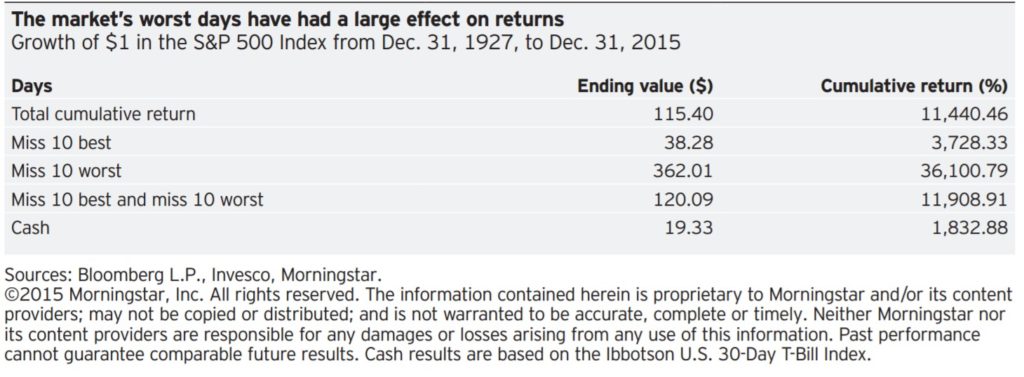

For an extremely long-term perspective, we can look at a recent study by Morningstar:

This study is very instructive because it tells me three very important things:

- If I miss only the best 10 days, my return is crushed – 3728% vs. 11440%

- If I miss only the worst 10 days, my return is much higher – 36100% vs. 11440%

- If I miss both, my return is only slightly better – 11908% vs. 11440%

Conclusion: Since I can’t time exactly when the best and worst days will occur, if I plan to invest for 88 years, it really doesn’t matter. Here’s a newsflash – none of us is going to invest for 88 years! Let’s examine a shorter, more realistic time frame.

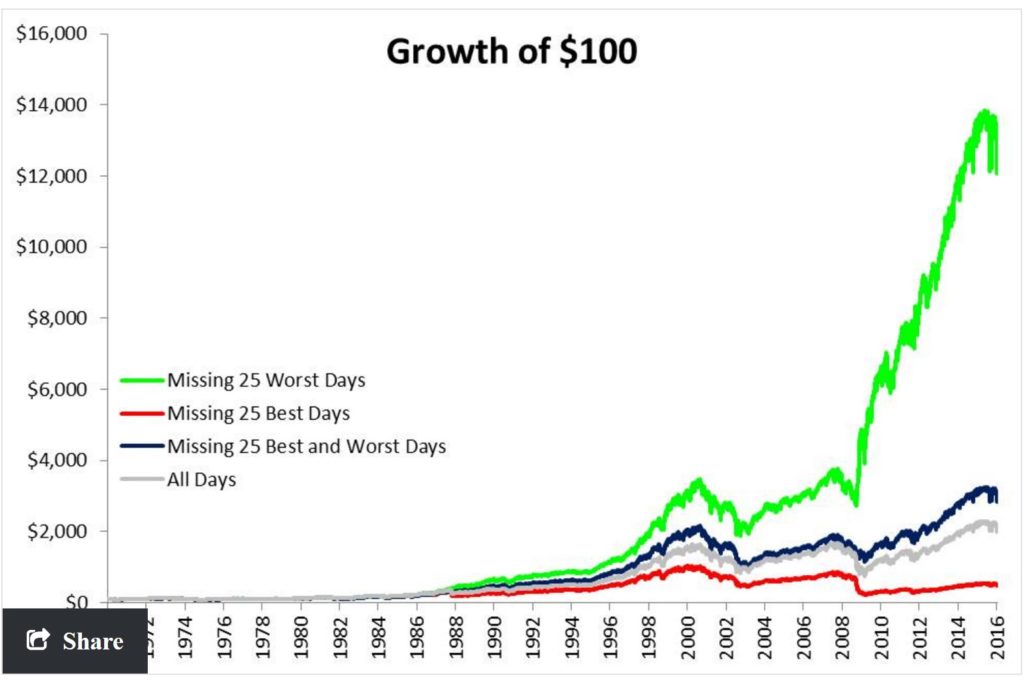

In a MarketWatch article of February 16, 2016, Michael Batnick, CFA at Ritholtz Wealth Management, performed the analysis of missing the best days versus missing the worst days since 1970. Here’s what he discovered:

- If you missed the 25 best days, your return shrank “from 1,910% to 371%, or 6.7% a year to 3.4%. To give you an idea of how lousy that is, 1-month U.S. T-bills returned 4.9% over the same period.”

- If you missed the 25 worst days, “The wizard who dodged these 25 days would have gained 12,045%, or 11% a year.”

- “But what if an investor avoided the 25 best and 25 worst days?” This returned 2,750% versus the 1,910% earned from the buy-and-holder.”

Source: Michael Batnick, Ritholtz Wealth Management

I am not suggesting that one will be able to time the market as to avoid the worst days, but I think the analysis clearly suggests that it’s okay to miss the best days if you can avoid the worst days.

So where does this leave us?

It is much more important to try to manage risk than to look to maximize returns!

In my own trading and coaching practice, I constantly emphasize the importance of managing risk. I sum it up in an observation I made many years ago when I was affiliated with the CBOE:

“New options traders focus on return first, experienced options traders focus on risk first.”