Finally, the Federal Reserve has moved off zero and put money in motion with the long awaited and exhaustively discussed rate increase.

The quarter of one percent rate is still negligible, with hardly a bump in the markets as per the well forecasted move. It was not a matter of if, but When rates had to rise and the year was about to end.

An old grizzled trader trick makes the federal funds futures the ideal tool to see what the markets had priced in for rate action. Subtracting the fed funds future price from 100 reflected the interest rate for the corresponding contract month.

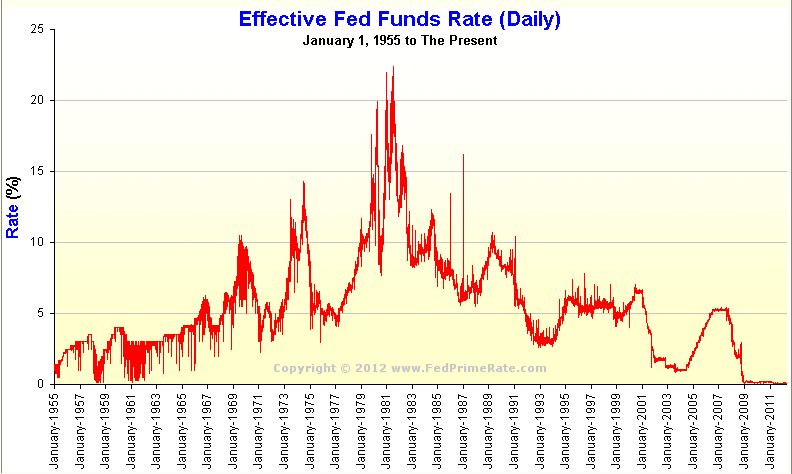

For example, 95.50 reflected a 4.5% federal funds rate, which is the average for the last fifty years.

A stair step in federal funds futures from one month contract to another reflects anticipated monetary action. The market which is often right can also get it wrong with those prices in flux as sentiment changes.

The first noticeable decline from current 99.75 in federal funds futures prices appears in the March and April contracts, which are both near 99.50. That FF action says that the market is expecting another rise of a quarter percent (.25).

Looking further into August and September, futures are priced near 99.25%. In December futures are priced at 99% to reflect two additional increases to total three in 2016.

Even with a 0.25% hike every quarter, it will still take until 2020 for the federal funds rate to revert back to its historical average.

A better knowledge of future federal fund action does not forecast how the markets will react. It is imperative to remember that money is not made predicting when events occur, but rather how prices move afterwards.