A stock is only worth what someone is willing to pay. Prices can always get cheaper, even for free falling stocks that you think will have value at some point.

Let’s take a look at Twitter. Their stock has fallen from it $75 peak in 2013 and the $50 at its 2015 high. The IPO price was $26 for a once shining stock with the first day trade at $45.

Fortunes have turned with Twitter solidly below $20 at the beginning of 2016. If it is any consolation, insiders that were gifted shares at the public offering price had two years to bank profits before prices fell.

With nearly a billion users, Twitter has been unable to unlock the monetary value of its customers.

Takeover talk has increased with suitors possibly lining up to take a crack at cashing in on tweeters. With a market capitalization of just over ten billion dollars, Twitter is on sale.

The high relative volatility in Twitter has made the out of the money options expensive.

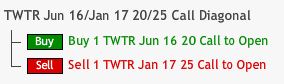

An example strategy would be to use a no or low cost buyout strategy. It could be employed by buying the June $20 calls with proceeds from selling the January $25 calls.

If a takeover is announced in the next five months, both options will bounce to the intrinsic value. The time component will evaporate leaving them worth the difference between the share price and the option strikes.

If Twitter was trading at $18 and bought out for a 25% premium at $22.50, that places the June option at $2.50 and the January option worthless if the deal is done.

This low cost strategy needs to be closed out in June before expiration if no buyers of Twitter appear. Don’t let the limited risk covered spread position morph into a naked call, simply buy back the January option and close trade.