Futures or commodities contracts offer investors and speculators a direct, highly leveraged vehicle to participate in the resource building blocks of the economy.

Not long ago, limited market hours were less efficient with major price gaps up and down when action again resumed from the previous session. That made executing a disciplined trading plan extremely difficult because of the price slippage. But now, electronic markets have revolutionized risk control with nearly 24 hour operation.

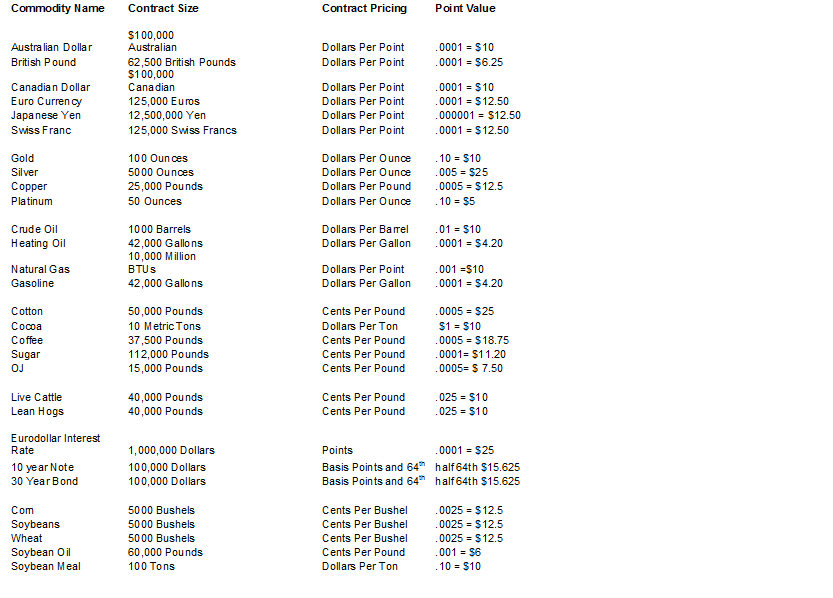

These types of contracts are standardized in size and months traded. Calculating point values is a function of contract size divided by the pricing unit.

For example, corn has a 5000 bushel contract and is quoted in cents per bushel. Therefore, every penny is $50 with price movement in quarter cents. If corn is trading at $2.75 per bushel, the next tick higher is $2.75 ¼ for a $12.50 move ($50 per penny times ¼).

While hundreds of commodities contracts are available to trade, only a few dozen (see cheat sheet) have the liquidity to execute a disciplined money management plan. It is critical that there are enough buyers and sellers to exit as per the risk control parameters.

While hundreds of commodities contracts are available to trade, only a few dozen (see cheat sheet) have the liquidity to execute a disciplined money management plan. It is critical that there are enough buyers and sellers to exit as per the risk control parameters.

Another important concern is to trade the front month contracts as they have the most volume. More volume translates into tighter bid/ask spreads for lower actual trading cost entering and exiting.

If you are still in a position when contract month is coming to an end simply roll into next trading month to extend opportunity window.

That’s it!