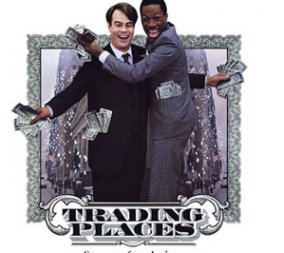

Trading Places, a movie about a commodities trader and a homeless man switching places, was one of the first VHS tapes that I personally owned (says a lot about me I’m sure) and had a major impact on my formative years.

My life journey brought me to the exchanges in Chicago with visions of orange juice futures dancing in my head (even though it traded in NY) and the fortune that I could make in a day’s worth of trading.

When you look back at the 1983 classic with a more critical eye, a few facts were embellished for entertainment purposes:

1. Taking a Profit Right at the Close

Billy Ray (Eddie Murphy) instructs the Dukes to not sell the pork bellies, looking for more of a capitulation in prices. He makes them an extra hundred thousand dollars on the trade by having them wait for his target price. The price is hit and it is assumed he takes profit right at the close. In reality, a print above his sale price would be required to make sure he is filled. P.S. Pork Bellies stopped trading in 2011.

2. Getting Access to be a Floor Trader

The process of getting access to be a floor trader is very arduous, not a next day affair like in the movie. A firm needs to sponsor you and a FBI background check with prints is required. Next is typically a one day class on trading mechanics and a comprehensive rules exam. The cost to buy or lease a trading badge is significant with a bond deposit to trade with.

3. Trading in The Pits

Trust and familiarity are crucial to open outcry trading in the pits. Just because you are physically on the trading floor,doesn’t mean you can trade. Every inch of the pit is desired territory with positions next to order flow fought for. Billy Ray and Winthorpe would find it difficult, if not impossible, to find someone to take the other side of their SIZE trades.

4. Limits on Trades

Orange juice had limits of ten cents per day that could be expanded if the markets were limited up or down at the close. The movie depicted a move from 40 cents to over $1.40, then back to close at 29 cents. This is an epic track that could only happen over weeks or months, not minutes.

5. Cornering the Market

Position limits for individuals and funds are designed to prevent cornering the market. The deposit required for each futures contract is typically five to ten percent of the cash value. Crop reports came out either before or after market hours. The live TV announcement in the middle of trading made for a dramatic movie climax.

6. Using Insider Information

The short trap set up for huge profits actually led to the “Eddie Murphy Rule” passed by congress. The use of inside information misappropriated from a government source was never prohibited in the futures markets. The 2010 law changed that as the government officials finally caught on more than 25 years later.