The latest diet fad in America is the social media detox.

Some folks go cold turkey, wiping their accounts clean. Other dieters delete apps like Instagram from their phone so they won’t compulsively check for new posts every ten minutes.

The goal is simple: to break the increasing stranglehold social media has on our lives.

“It consumed too much of my time, and I had stopped doing other things I loved to do,” one social media dieter confessed to Mashable.

But the addictive powers of social media are strong. After a two-week break, she admits she’s still following her friends online.

“I re-downloaded the app, but I deleted my personal account,” she said. “Now I just have an account for my dogs which is easier to manage and doesn’t consume me as much.”

We’ve talked a lot about smartphone zombies recently. Unfortunately, most of us can’t walk from our driveways to our homes without burying our noses in our phones to complain about politics on our Facebook walls or like a few Instagram posts.

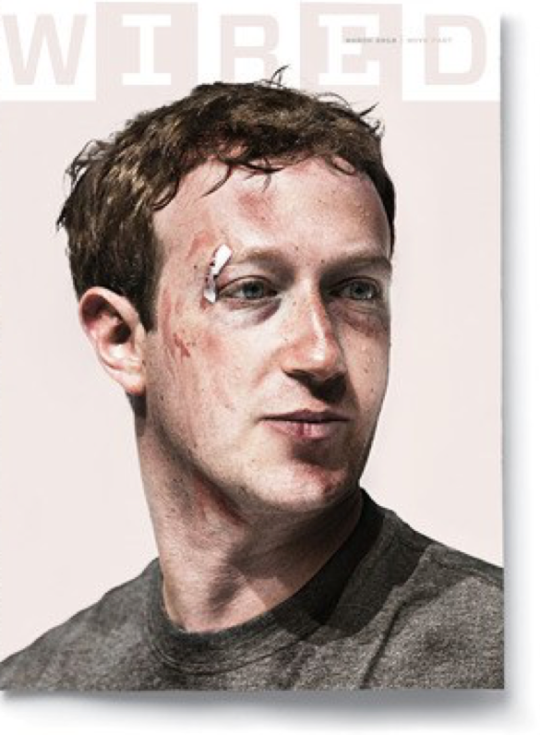

Despite social media’s powerful influence, we’re beginning to see some backlash. Some of it is coming in the form of user detox plans. But other forces are also at work. Facebook (NASDAQ:FB) has already come under intense scrutiny for its failures to adequately vet false and misleading news stories on its platform during the 2016 election. In, fact Wired just published a huge story detailing Facebook’s missteps regarding the fake news debacle featuring a bruised and battered Zuckerberg on the cover:

Between these newfound reputational problems and recent stock performance that’s lagging some of its other mega-cap tech peers, we decided to take a step back and book profits on our Facebook position last month. While Facebook will probably end up just fine in the long run, the tide could be turning for this social media juggernaut’s stock this year. If more users and regulators begin to view using Facebook as an unhealthy or dangerous pursuit, the company could be in for a rough ride.

While Facebook is taking the biggest reputational hit during the recent social media backlash, its smaller competitors are actually starting to perk up…

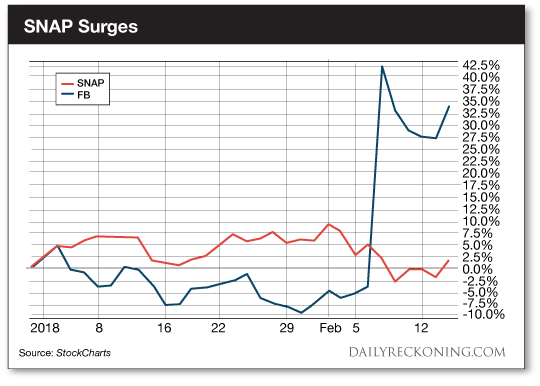

When we cashed out our Facebook trade last month, we noted how Twitter Inc. (NYSE:TWTR) had recovered more than 50% over the past five months, compared to a paltry 7% gain posted by Facebook.

Yes, that Twitter — the company that has never done anything right — is now up 100% over the past six months, and more than 40% year-to-date. Twitter even booked its first profit last week, helping to push shares to two-year highs.

Twitter isn’t the only social media also-ran to catch a bid this month.

Snap Inc. (NYSE:SNAP) also posted a bang-up quarter, launching the stock off its lows. Facebook has bullied Snap ever since the it went public in early 2017. Now Snap is making a big push for new ad dollars by opening its platform to ad agencies and other tech firms, Business Insider reports.

Snap’s sudden comeback has helped propel the stock to gains of nearly 35% year-to-date. That easily tops the 1.7% gains from mighty Facebook.

Snap has already come a long way since its rocky 2017 IPO. Along with Twitter, these second-tier social media stocks have been dead money walking. Not anymore.

Looking for a proven, repeatable way to make easy, higher-potential trades?

In this limited-time free training, you will learn 3 super simple tricks used to generate consistent profits from day trading weekly options…