Have you ever noticed that after most big announcements, the markets tend to run in one direction quickly, only to turn and go the opposite direction?

These are called moved knee jerk reactions and they don’t typically last more than 30 minutes. These 30 minutes though, could help you make a huge profit.

Here is a quick way to try to make a few bucks the next time the Fed announces a rate hike.

Step 1

Wait for the announcement and see what direction the market runs right AFTER the news hits the stock market.

Step 2

Wait 30 minutes. Depending on the topic and severity of the issue this period of time might be too short. However, Fed announcements this has typically been the case.

Step 3

Place a trade betting the market will turn and go the opposite direction once people feel that the news is not going to make a bit of difference and cooler head prevail.

Look to capture the entire reverse and be ready to flatten the trade if the volatility does not settle within the next 30 minutes.

Of course, this does not work 100% of the time, but consistently in my trading career I have seen news hit the markets and cause amateurs and professionals to overreact. Shortly after, the market gives back its move and carries on.

Turns out, I am not the only one who’s caught on.

I recently came across this article from Mark Hulbert with MarketWatch where he breaks down his trade idea:

I’ve got a suggestion for a short-term trade for profit from the Federal Reserve’s interest-rate-setting meeting this week.

Wait 30 minutes after the Fed has announced its decision—expected at 2 p.m. New York time on Wednesday. Then bet that the S&P 500 SPX, +0.45% or other broad-market index will soon move in the opposite direction of how it immediately reacted.

The rationale: The Fed’s decision has virtually no real-world stock-market consequence besides giving an obsessive-compulsive Wall Street something to endlessly analyze — even with a new “dot plot” showing Fed officials’ expectations about how quickly interest rates will rise and a news conference with Fed Chairwoman Janet Yellen. To use a quotation often attributed to Star Trek’s Dr. Spock: A difference that makes no difference is not a difference.

It’s therefore a good bet that the stock market’s reaction to the Fed’s interest-rate announcement will not be based in reality and will soon be corrected.

I know you will be shocked to learn that Wall Street is obsessed by something that has no real-world significance. But there are at least two reasons why the timing of the Fed’s rate increase is not even close to being the big deal that most are assuming it is.

The first is related to the present value of a company’s future sales, earnings and dividends. As you may remember from Finance 101, other things being equal higher interest rates mean that we need to deeply discount future sums when calculating present value.

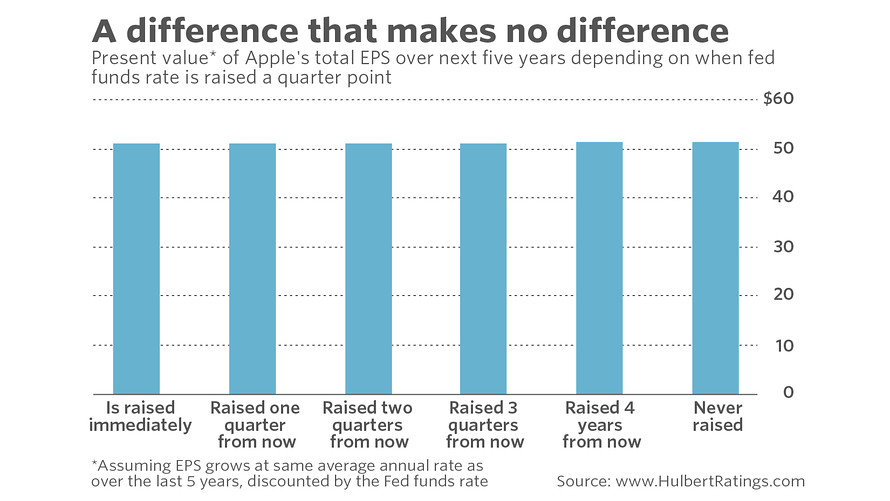

But the actual impact is surprisingly modest. To illustrate, I calculated the present value of Apple’s AAPL, +0.20% total earnings per share over the next five years. I assumed the firm’s EPS would grow over the next five years at the same rate as it has over the last five and that future earnings should be discounted at the fed-funds rate.

If the fed-funds rises on Wednesday at rate by a quarter point to 1.25% and there are no other changes for the next five years, the present value of Apple’s next five years’ EPS comes to $51.05 in today’s dollars. In contrast, this total would be $51.40 if the Fed instead keeps them at the current level of 1.0% for the next five years.

In other words, the difference between an immediate rate hike and an indefinite postponement comes to 35 cents of total five-year EPS. The impact of other adjustments is even smaller. It’s hard to see how any of these possibilities makes any significant difference.

To be sure, higher interest rates could have other real-world impacts besides a higher discount rate. For example, they might discourage corporate investment which could certainly lead to a diminution in companies’ long-term growth rates.

John Graham, a finance professor at Duke University’s Fuqua School of Business, says there is little evidence that the timing of the Fed’s rate hike will have such an impact. He bases this belief on the responses he has received from chief financial officers in the quarterly CFO Survey:

In an interview, Graham told me that CFOs for a number of quarters in a row now have not reported that the timing of interest rate hikes is material to their financing decisions. He said that this CFO consensus remains the same in the latest survey, whose results are being released on Tuesday—and which, crucially, was conducted when it was all but certain that the Fed would raise rates at its mid-June meeting.

Graham added: “Because the rate hikes that the Fed is anticipating are incremental enough, and are being contemplated at a time when rates are already so low, the possibility of one or more rate hikes is at or near the bottom of the list of factors that CFOs report could have the biggest impact on their corporate financing decisions.”

The bottom line?

As Humphrey Neill, the father of contrary analysis, insisted: “When everyone thinks alike, everyone is likely to be wrong.”