The stock market comeback in the last six months has added $2 trillion dollars in value to the U.S. markets. It’s certainly a big number. In fact, it can push the total capitalization here to almost $20 trillion.

Here’s some simple math for you:

Capitalization = Outstanding Shares x Current Stock Price

A wall of worry has been overcome once again on the 10% plus bounce, as America is looked at as a standard bearer for the world. Instability in Asia and slow growth in Europe has made U.S. corporations the investment area of choice.

For all the focus on potential problems, none have developed into a catalyst for Humpty Dumpty to fall. In the last few years, concerns ranging from Japan’s tsunami tragedy, to the Euro currency crisis, Cypress insolvency, Greek debt debacle and the Crude crash have been unable to beat the Bull Market.

Contagion was the fear and often temporary panic ensued, but once it was thought through did the global giant gain lost ground.

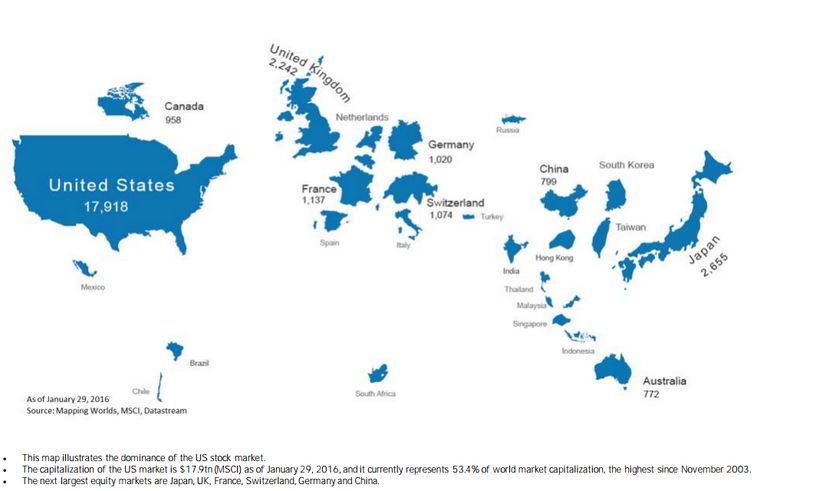

In capitalization terms, the U.S. stock market makes up more than 54% of the global stock markets, according to Bloomberg.

A Bank of America Merrill Lynch research note put the picture in perspective, showing capitalization represented by size (based on January 2016 numbers).

Here are the biggest countries:

- United States – far and away leader at $18 trillion market cap

- Japan – $2.65 trillion

- United Kingdom – $2.24 trillion

- France – $1.14 trillion

- Switzerland – $1.07 trillion

- Germany – $ 1.02 trillion

- China – Less than $1 trillion with Hong Kong almost equal value. This number may seem low as it excludes A shares from the calculation.

China is all that was heard since that stock market bubble popped. In reality, the Chinese market gave back a big run up, where stocks doubled in a short time.

The lesson learned here is that when a global player gets sick, it doesn’t mean that the New York markets will catch a cold.