Corporate profits, including quarterly earnings, are regularly released for eager market watchers. The eagerly anticipated new season starts in mid-April.

Usually, the information is priced in with analyst consensus numbers, with the over/under level to follow.

Earnings and revenue numbers above or below estimates are what typically shake up shares.

The “what have you done for me lately” mentality has gotten people worried about what a stock might do in the distant future. Guidance has taken greater importance in this now slow growth environment, as recession fears persist.

April 11th marked the kickoff of the Q1 earnings as the one time Dow stock Alcoa starts the season unofficially. Alcoa has gone the way of the buggy whip, as its time as an industrial gauge.

Big banks follow the next week to set the financial tone for the quarter when Wells Fargo, JP Morgan, Bank of America all disclose their data.

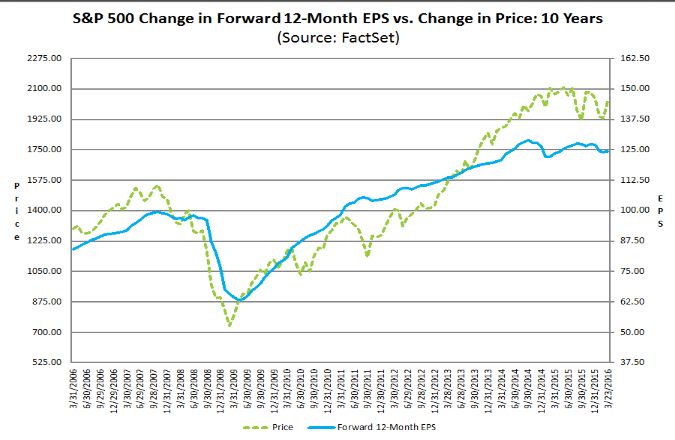

According to FactSet, a leading provider of integrated financial information and analytical applications, here’s their earnings insight, or known as the S&P 500 Stocks Scoreboard:

- Earnings Growth – The estimated Q1 earnings decline is at minus 8.7%. If it were negative, it would represent four consecutive quarters of year-over-year declines since 2008-2009.

- Revisions – The December 31st growth rate estimate was plus 0.3%. Interestingly, S&P prices are nearly unchanged against the free fall in expected earnings.

- EPS Guidance – 93 companies have warned about lower Q1 earnings, and 26 have issued positive guidance. The 78% of those who announced previously coming out with negative guidance is above the five-year average of 73%

- Valuation – The S&P forward price earnings ratio stands at 16.4, solidly above the five-year 14.4 and ten-year 14.2 averages.

The Q1 line in the sand has been drawn, as analysts have anticipated earnings performance, pushing prices to where they stand today. Let the fundamentals flow to give the market information to go.