I wrote an article several weeks ago pointing to the IPO of SNAP (snapchat) as an indication of how this market was eerily similar to the stock market near the end of 1999. You may also know that I believe this market has the triple witching warning signs of high valuation, high enthusiasm, and rising interest rates.

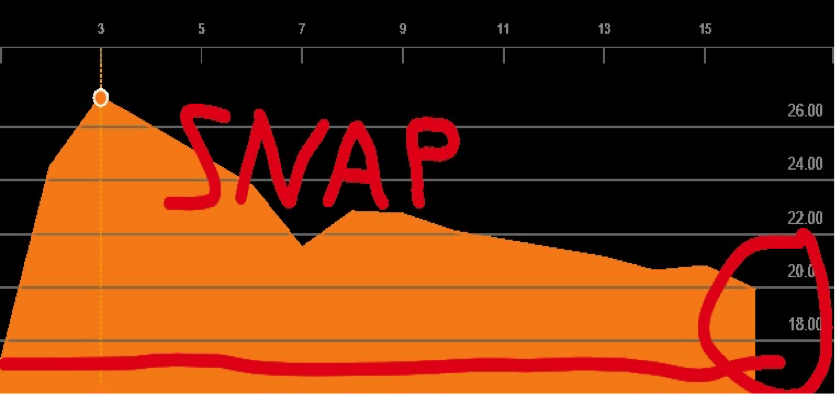

As you are probably aware, SNAP was IPO’d at $17 and immediately rose to above $28 as investors flocked to this hot new tech name. But look what has happened since then:

SNAP has been in a steady decline, and just weeks later was trading below $20. That’s over 30% lower than the highs of that first day of trading.

I am not going to write about the fundamentals of the company, but I do want to tell you about the technical aspects of how IPO’s work.

Before the company gets listed on an exchange the underwriters call around to all of their buy-side customers asking them if they want to participate in an IPO before it gets listed. These buy-side customers are the biggest stock traders in the world, and as such, they generate billions of dollars in commissions for the investment banks that are the underwriters. These underwriters do everything they can to IPO the stock at a price that will MAKE MONEY FOR THESE INSTITUTIONAL CLIENTS. For example, SNAP issued 200,000,000 shares at $17. Large institutions got to buy 200,000,000 shares at $17. When the stock traded up to $28 on the first day of trading these institutions had a profit of $2.2 billion!

I am not here to talk about the incredible unfairness of the IPO process. Small investors like you don’t get to participate in these profits. I can’t change the world, but I can help you make money.

Now, this symbiotic relationship (between investment banks and huge money managers) only works if the IPO’d stock trades higher than the IPO price. The investment banks will “defend this price” as long as they can. That means they will go into the market and buy shares if the price drops near the IPO price. In this case $17. We are not there yet, but I can assure you a lot of big players are getting nervous.

The key thing to know is that investment banks desperately want the price to stay above $17, but the large institutions get very nervous as the price drops near this level. They do not want to lose money on an IPO. Now, sometimes the investment banks win this battle and sometimes they lose. Already the institutions have given back $1.6 billion of their $2.2 billion profit.

OK, that was a lot of technical “inside baseball.” But what can you do to profit from this game?

I believe that the whole market is dependent on SNAP right now. If the investment banks lose the battle this time, and SNAP cracks the IPO price, I believe there could be a rush to get out. If this happens, I think it will be a catalyst for the whole market to sell off.

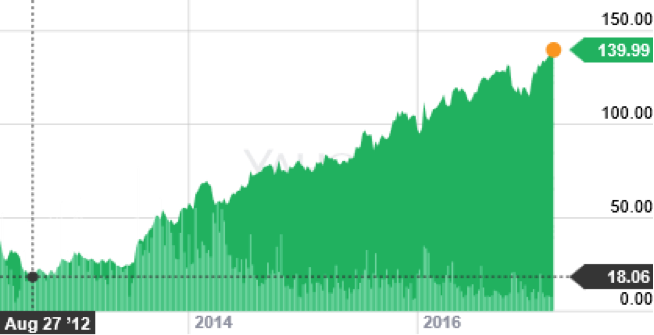

But, if SNAP doesn’t break $17 then there could be significant upside. And for you, that means you can buy the latest hot new social media stock at a very close price to where the “big boys” got to buy it. Back in 2012 Facebook (FB) had a disastrous IPO and traded well below “the price”. The details are much different but look at what you could have done if you bought.

That’s a 700% profit in less than 5 years. Sometimes these games played by huge professionals backfire on them and you can take advantage. I believe SNAP will hold $17 and will be a great long term holding for you. In fact, I would start putting on a position now, but keep 25% to 50% in reserve just in case it cracks $17.

I’m old and would never use Snapchat, but I hear the kids love it. And I love making money so I would start buying.