This shortcut is not a new discovery, but I often wonder why more investors don’t use it. Maybe because it uses that off-putting term, “option selling.”

Questions to consider:

- Are you a stock investor who is interested in buying stocks at a significant discount to current levels?

- When trying to buy a stock at a good level and unfortunately not getting filled, would you prefer to simply miss that trade or be paid a significant amount of compensation and generate an income stream?

- Do you have in mind some specific stocks that you would be happy to own?

Here is an example of what I am talking about:

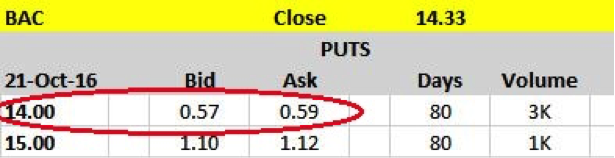

These are the prices of a couple of put options on Bank of America stock that expire in a little less than three months’ time at the time of this writing. This is not a suggestion to do this trade, just an example of how such a trade works.

Say that you are happy to own BAC stock. You could simply go into the market and buy shares at around $14.33 with a market order. You could put in a limit order to buy at, say, $14.00 and hope for a decline in the price to that level. Another thing you could do is sell BAC $14.00 October puts at $0.57.

Assuming you sell the puts, let’s work through what could then happen. At the time of expiry, BAC could be:

- Higher than $14.00. The puts will expire worthless, i.e. you won’t get the BAC stock but you will get to keep the $0.57. That works out to nearly a 4% return in less than 3 months, which isn’t the worst result for a trade that went “wrong.”

- Lower than $14.00. The puts will be exercised and you will have to pay $14.00 for the BAC stock that you now own, even if BAC is significantly lower. You do still get to keep the $0.57, so in effect, you got to buy BAC at $13.43 – more than $1.00 less than the investor who just went into the market and bought at the current price of $14.33.

It’s true that you also don’t get dividends until you actually own the stock – but BACs dividend yield is about 1.5% per year, not about 4.0% per quarter. And this is not an unusual example!

You should only do this trade on a stock you are happy to own because there will be times you actually end up owning it – but it is a much better way to own stocks at a discount than just jumping into the market and buying on the spot.

Simplicity should be an investor’s closest friend, not his passing acquaintance!

Want to learn more options strategies from Michael Cook? Click HERE.