Purchasing stock shares is now extremely easy with just the click of a computer mouse using an online brokerage account. For retail investors, going long makes up for an inordinately large portion of their trading activity, leaving out significant profit opportunities on a price fall.

The buy low and sell high objective often neglects to start with the sale. As we all know, stocks go down, sometimes faster than we initially realize.

Shorting simply starts with the sell first on the hopes of closing out the position with a buy at a lower price later. The concept selling something first is foreign to many, but must be mastered to take advantage of dynamic market conditions.

The short interest in an individual stock is an important indicator of sentiment. Those who have sold tend to be more sophisticated professionals that are in the know. They feel that the shares are overvalued and due for a downturn.

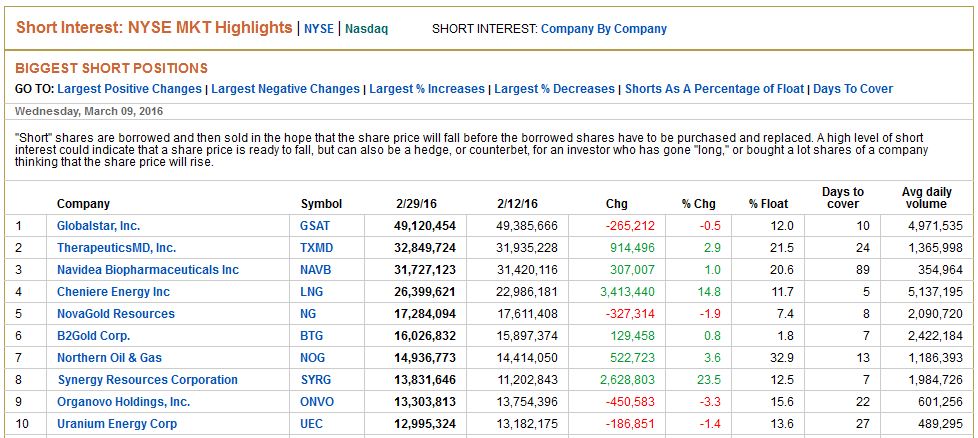

Regular reports are issued by exchanges with the data to show stocks with the most shares short that will eventually need to be covered and closed out, like the one shown below:

This information is released bi-weekly though a delayed snap shot in time of the previous week.

The percentage of shares short is the number sold, divided by the total of share outstanding. That percentage and its changes reflects stock sentiment and the shifts therein.

A deeper dive in the data dividing the number of shares short by the average daily trading volume gives the days to cover ratio. The more days it’ll hypothetically take to close out the position, the more committed the short side are to the sellers.

Contrarians look for heavily shorted stocks to bounce when buying forces buying back the borrowed shares. A short squeeze is a rush to the exits when sellers are scrambling to buy the stock to limit losses.

By itself, short interest is just another fundamental fact to consider when investing in a stock. The percentage of short interest and the change in that conviction over time can be insightful information about what experienced investors may see for the future.