Imagine getting paid every three months for 25 years straight. Not a single missed payment just from owning a stock.

How is this possible?

I wish I had a super secret investment to tell you about, but it’s simply dividends. Yup, dividends on really smart companies that grow slowly, but surely.

There is even a name for these companies: The Dividend Aristocrats. They are a small group of companies listed on the S&P 500 that have increased dividends every year for 25 straight years (not once missing a payout to investors).

With interests rates so low, many investors are looking for consistent and safe places to receive income from their investments. Post-2008, the world’s favorite place to look for a payout is the U.S. stock market and the high caliber companies that have been able to pay consistent dividends.

Do you own dividends? Are you looking for more income each year? If you have the right risk tolerance and want to reconsider your current portfolio allocations, then take a look at these quick tips to finding what might be the right dividends for you:

- History and Consistency – Look for a lower yield that has not wavered.

- Reinvest Dividends – The power of compounding is the main motivation in selecting dividend stocks.

- Understand Tax Implications – A well-known expression: What you keep is more important than what you make.

- Dividend Growth Matters – Raising the dividend can be a sign of corporate health. Even just a few cents a year can signal stable management.

There are just over 50 stocks that have been able to grow these dividend distributions payment counts in 2016. About 25% of them can be found in the consumer staples sector – lending credibility to the stability of that market.

What are these stocks? Think slow and steady Coca-Cola, Proctor and Gamble, and Clorox.

Check out this link to view a complete list of Divident Aristocrats: <http://www.simplysafedividends.com/dividend-aristocrats/>

Take a look at this compelling example of how dividends might do you and your portfolio some good.

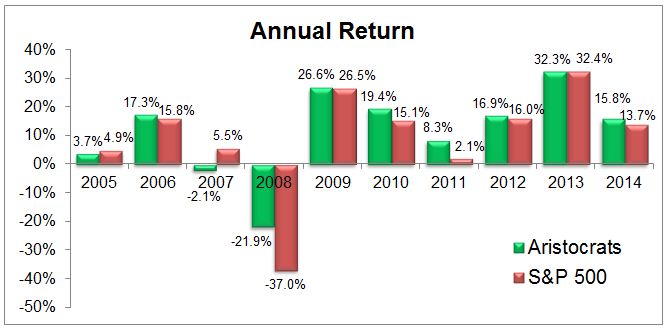

The following graph shows annual returns for Dividend Aristocrats along with the annual returns for the S&P 500. Looking at 2008, Dividend Aristocrats went down about 22% but preserved shareholders’ capital significantly if you compare it to the S&P 500’s 37% dive.

The impressive thing is that these Dividend Aristocrats still fared well despite the financial crisis and its following years. They outperformed during down markets and kept up in up markets, which resulted in attractive risk-adjusted returns.

At the end of the day, who wouldn’t want to get paid a respectable return on their money every three month for the next 25 years? In this “Free Money” economy don’t expect interest rates to come back soon. Find good companies with a solid track record for paying out consistently and ask yourself if this is right for you.