In my almost 60 years of trading, I’ve learned a few things that most every short-term trader needs to know. The biggest error short-term traders make is thinking they can trade every day the same way; essentially, that all trading days are the same. That’s not correct.

Some days are much more prone to substantial market moves up or down than others. Traders must identify these high opportunity days, or they will be caught fiddling back and forth on days that do not develop adequate ranges.

So how does one find favorable trading days?

The easiest way is to look for a contraction of volatility or range as markets move from large ranges to small ranges and from small ranges to large ranges.

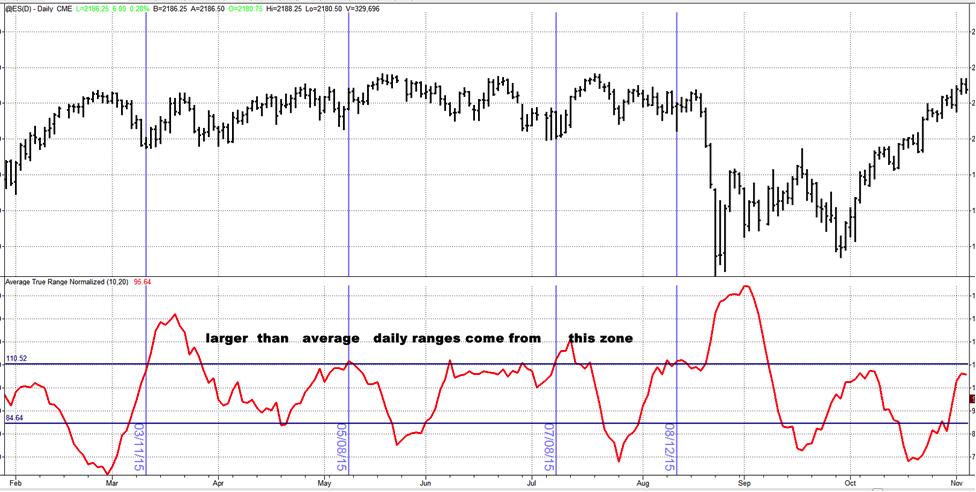

The following chart illustrates the point. It shows the difference between the average ranges of the last 10 days versus the last 20 days. Note that at high levels we see larger ranges for the next few days, giving us an opportunity for larger profits.

What this means to short-term traders is to use volatility, or other indicators, to identify times when the market is most likely to have large ranges. There’s not much money for very short-term traders to make if the daily ranges are very small.

Traders need volatility…

There are indicators, such as the one shown here that will help identify the trading days to get the most bang for your buck. The overriding rule I have found in my research is congestion. When there has been a congestion or small changes from close to close, small ranges, small openings to openings, one will soon see explosive moves.

Learn to use charts to predict volatile days so that you can amp up your trading on the right days.

To discover two other big errors that prevent short-term traders from profiting, and more trading tips, click here.