Typically, I don’t pay attention to stock market maxims; in fact, these phrases are one of my biggest pet peeves. But the adage of “don’t fight the Fed” is one that I do pay close attention to, especially right now.

To see where our current situation is rooted, we need to look back a few years…

In reaction to a major global credit crisis that almost destroyed the entire banking sector in 2008, the Fed lowered interest rates to near 0% in late 2008—fueling an eight-year stock market rally. But this policy merely replaced a corporate credit crisis with a governmental credit crisis.

Now the Fed is determined to normalize rates, and this is bad news for the stock market.

The U.S. Treasury Market is One of the Biggest Bubbles in History… And it’s about to burst.

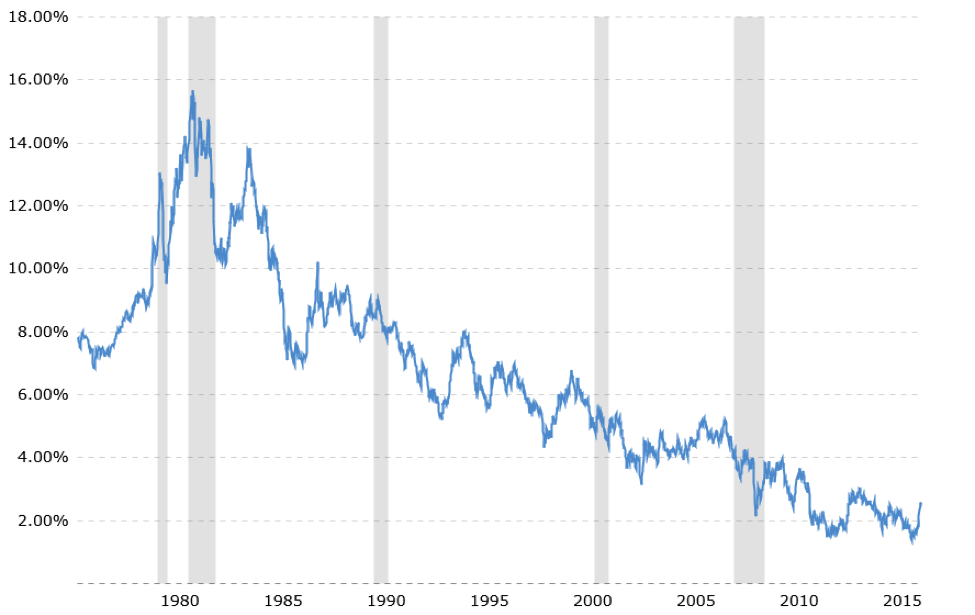

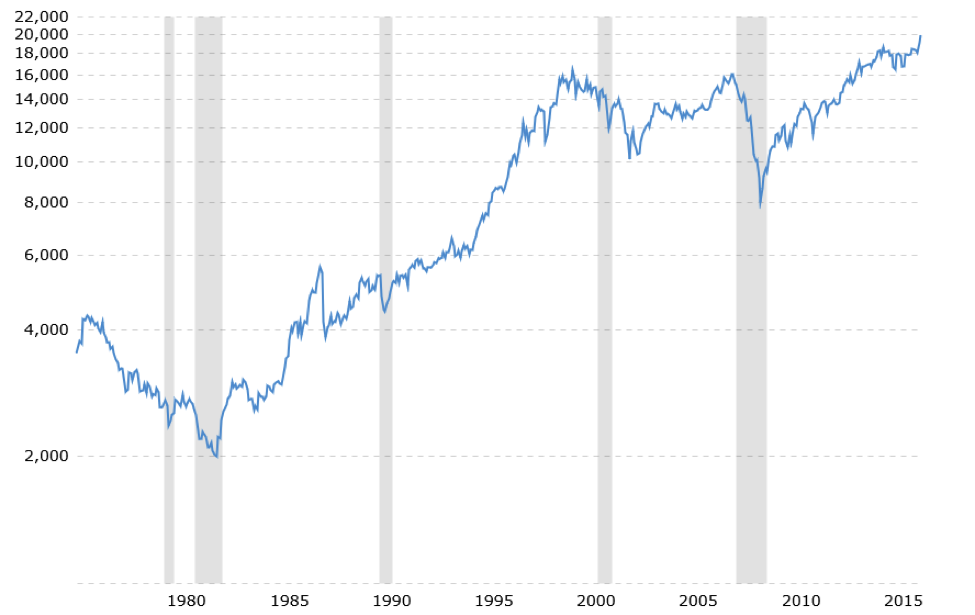

Here is a graph that shows U.S. interest rates declining for over 35 years, as well as the corresponding Dow Jones chart that shows a 35-year bull market.

U.S. interest rates dropping for over 35 years.

A 35-year bull market shown through a Dow Jones chart.

As you can see, since 1981, U.S. 10-year Treasury rates have declined from 15% to 2%. In the same period, the Dow Jones Industrial Average rose from 2,000 to 20,000. These are obviously two huge bull markets that have lasted over 35 years.

The stock market crash of 2008 showed us that this golden era of low rates, and unsecured credit was over. Unfortunately, instead of allowing the economy to heal itself, the government decided to prop up markets and artificially continue the bull run. But the Fed can’t keep interest rates at historical lows forever, and Janet Yellen has decided that now is the time to normalize.

For over a year Yellen has been trying to raise rates and the markets have been fighting her the whole way. Every time the Fed started talking about raising rates the stock markets have sold off hard. They have only managed two rate hikes in the past year, but more are on the way. The euphoria over the Donald Trump presidential victory has rallied markets which allowed the Fed to raise rates .25% in December of 2016.

But there is a very ominous sign at the tail end of the first chart. The 10-year Treasury rate has risen from 1.5% to 2.5% since the election, and this is what I mean by “don’t fight the Fed.”

Equity valuations are high, euphoria is high, and interest rates are rising. Even in normal times, I would not be buying equities under these conditions. And circumstances are much worse than normal. I know 2009 seems like a lifetime ago, but as you can see from the chart the Dow Jones was trading at 8,000, and now it is 20,000. I guess the government did a great job? Not likely.

Governments have endless ways to redistribute money and resources. They can take from the rich and give to the poor, they can take from future generations and give to the current generation, and they can remove debt from corporations and put it on their own balance sheet. But redistribution is the only thing governments can do.

Despite what you hear on television, governments cannot “create” jobs or “stimulate” economies. They can merely take jobs from future generations and give them to the current generation. Or, they can borrow future economic growth and bring it to the present. But, governments cannot create economic growth or jobs.

In 2008, the markets told us that the 30-year bull market in equities, treasuries, and credit was over. But world governments decided they didn’t want the party to end so they borrowed from the future to keep it going. It is now time to pay the bill. That payment will be in the form of much higher interest rates, and that is not good for equity prices.

I believe the 35-year decline in interest rates and corresponding bull market in equities is over. Global markets tried to tell us that in 2008, but it was artificially delayed by world governments. 2017 will be a very bad year for equity prices, and interest rates will continue to rise, possibly dramatically, if the 35-year bubble bursts. This is no time to be long equities. For conservative investors I recommend cash, and for professionals I recommend buying puts.

Don’t fight the Fed.