The VIX is calculated using a rather complex formula to derive expected volatility by averaging the weighted prices of out-of-the-money puts and calls. Fortunately, the calculation is performed by the CBOE exchange, so the trader doesn’t have to perform complex mathematical calculations to derive volatility levels manually.

There are two common misconceptions that many beginner options traders have about the VIX index. First, VIX uses both puts as well as calls to calculate it’s value. I’ve stumbled upon several articles and videos over the past few years that forget to mention that calls are involved in the calculation to the same extent as puts.

The “Fear Indicator”

Second, because the VIX is often times referred to as the “fear indicator”, it’s assumed that VIX levels will only move higher when the stock market moves lower. While historically, put options tend to increase in volatility much more rapidly when markets move lower; if the stock market begins moving higher and options traders believe the market will continue moving higher, the level of volatility can potentially rise in the VIX levels to the same degree.

So don’t assume that VIX levels only rise when markets are moving lower, in reality VIX levels move higher when volatility rises, regardless of which direction the market is favoring at the time.

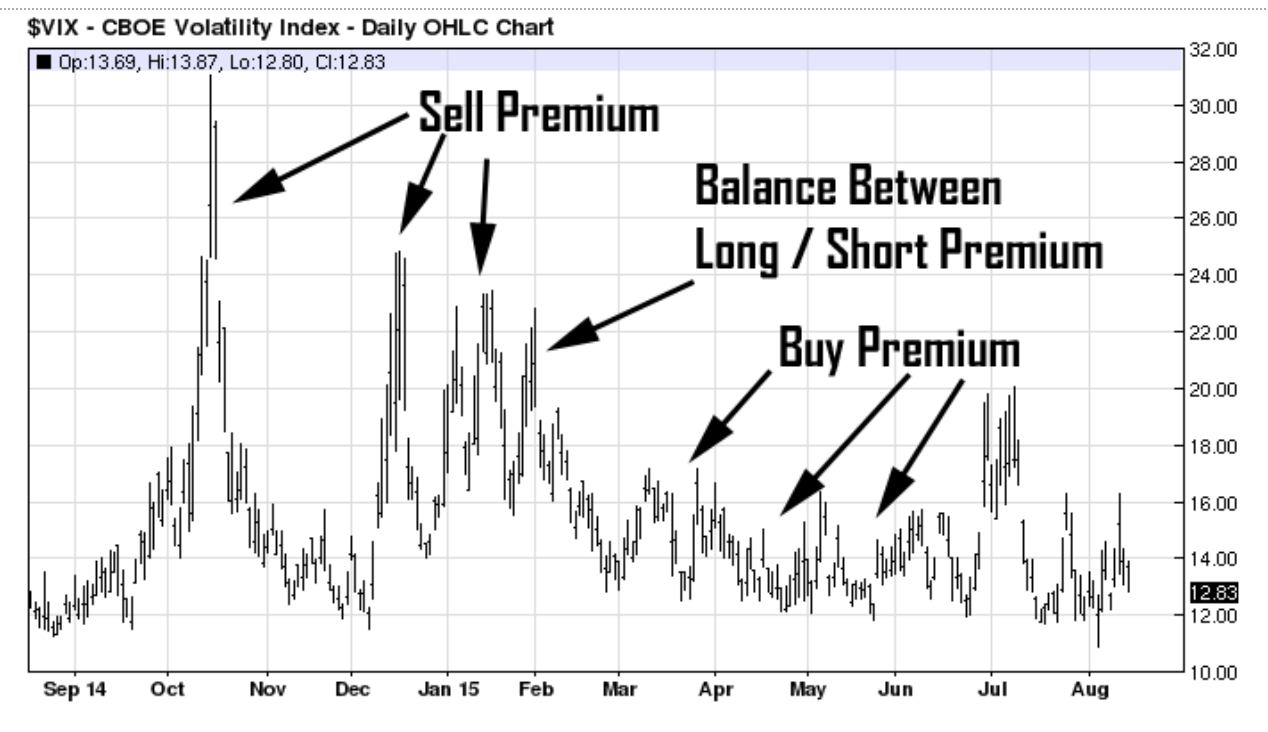

Since VIX index measure the implied volatility levels of the SP 500, it’s fair to say that VIX levels offer a fair representation into the volatility level of the overall market or the broad market. In other words, if VIX levels are unusually high, there is a strong chance that the majority of near term options are overvalued at the time, since overall market conditions are implying a high level of volatility and trading range over the next month.

Conversely, if VIX levels are low, the majority of options will be undervalued, since overall market conditions are implying a low level of volatility over the next 30 days.

For Example…

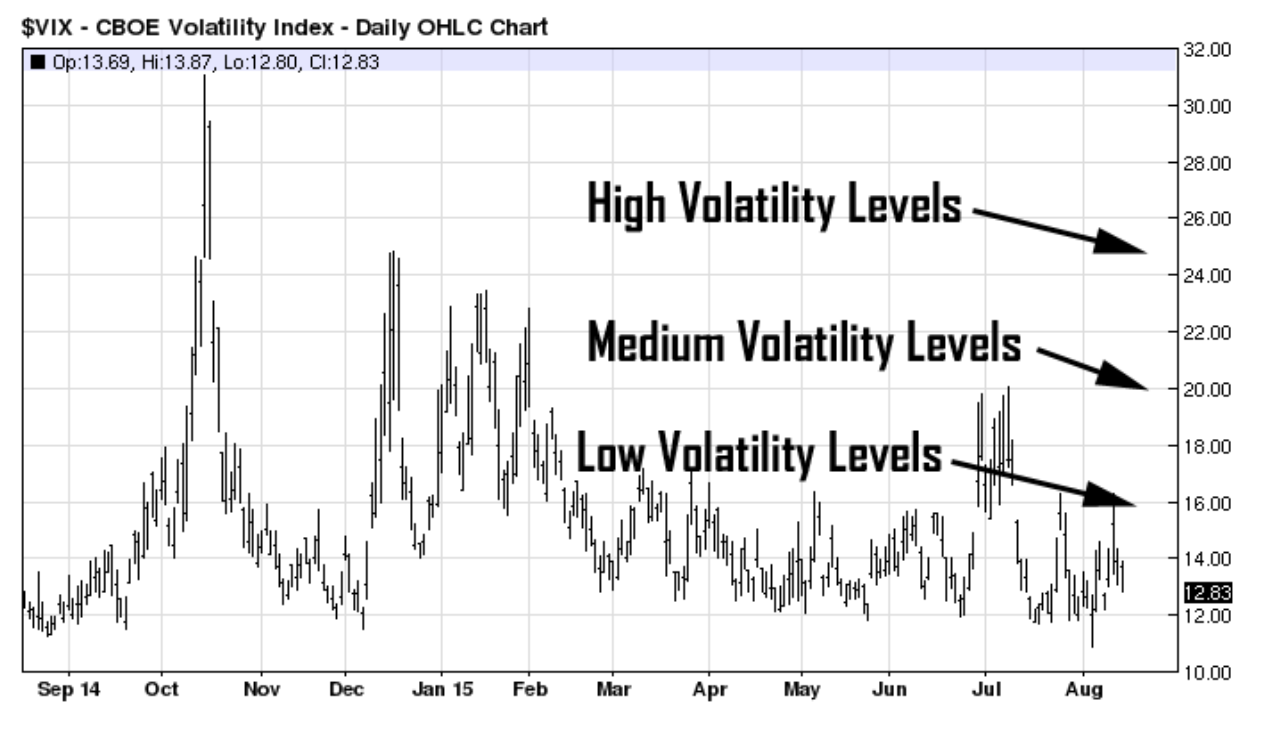

In the chart below you can see a daily VIX chart updated daily, over a period of one year. On the right side of the chart, VIX levels are shown; ranging from 10 to 32.

As a general rule of thumb, if VIX levels are below 20, the current market sentiment implies that options are fairly priced and portfolio that consists of 70% long options positions is reasonable.

If VIX levels begin moving above 20, options are starting to become a bit overvalued and shifting part of your portfolio into neutral and short positions may not be a bad idea.

If you VIX levels rise above the 25 level, the market is exhibiting high volatility levels and buying options during this period is not advisable, because volatility can decrease very rapidly and you can get caught in what is called a “volatility crush”, which occurs when volatility moves from extremely high levels to very low levels in a very short period of time, causing overpriced options to decrease in value rapidly, even though the underlying asset stayed at or near the same price levels.

On the other hand, buying options when VIX levels are very low can help you gain an edge when VIX levels rise quickly; since options that are long VEGA will increase in value even though the underlying asset maintains the same price levels the entire time.

“Don’t underestimate the power of implied volatility, it’s can cause the price of an option to increase exponentially and decrease just as quickly, while the underlying asset remains at or near the same price levels the entire time.”

The More Diversified The Portfolio The More It Will Behave Like The Overall Market

Keep in mind, not all stocks follow the overall market and some stocks may exhibit extremely high levels of volatility when the overall market is very calm and conversely, there could be times when the overall market is very volatile, while an individual stock is barely moving, so you do have to consider every asset and it’s option individually.

With that said, most traders don’t just trade one option at a time and when you put together a portfolio of several different options, the portfolio will begin to react more like the overall market and that’s when overall VIX levels will become important.

Wishing you the best in your trading.

Roger Scott

Head Trader

Options Geeks