“Bitcoin is dead!”

At least that’s what the financial pundits and mainstream media want you to believe…

It seems like we can’t make it a single day without a so-called “expert” or financial guru claiming that the “Bitcoin experiment” has finally met its long predicted demise.

Heck, as of this writing, Bitcoin has been declared “dead” over 300 times since its inception in 2009.

You’d think they would’ve learned their lesson by now…

But no…

Instead they observe the same patterns repeating over and over again assuming that this time… It will be different.

In the world of cryptocurrency (much like traditional investing), when the price drops, investors fear the worst.

And right now, Bitcoin’s price is dropping like a dress on prom night.

In early January, one Bitcoin was worth nearly $20,000, and Ethereum was selling for more than $1500. (Now, it’s worth about a third of that.)

As the price skyrocketed in 2017, nearly everyone and their step mom was buying cryptocurrencies.

Investors took out loans, overleveraged themselves, and invested in projects they knew nothing about.

It was a time of greed and extreme optimism… and many people became filthy rich.

For savvy crypto investors, life was good… very good.

You might have been part of the lucky few who took part in this digital gold rush, and hopefully you cashed out.

Because the hot market didn’t last…

Most crypto investors lost massive amounts of wealth as their beloved coins dropped 90% (or more) from their all time highs.

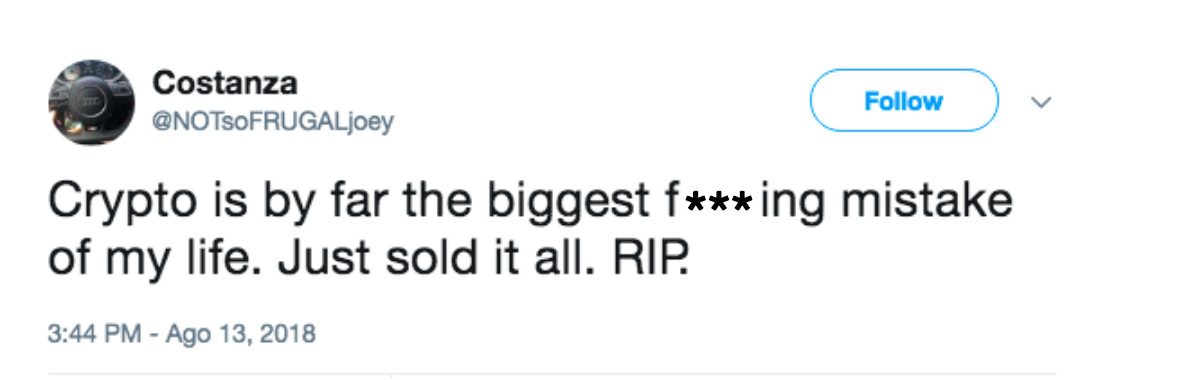

This retraction left a sour taste in most people’s mouths, and the vast majority of retail investors left, calling it quits on crypto.

Not everyone was so short sighted, though.

Some investors stuck around…

They cashed out and shorted positions, making money even as the vast majority of investors were losing their shirts.

How did they do it?

To the layman, it might seem like they were simply financial wizards.

Almost as if they knew it was coming – and in fact, they did. Because they had seen it all before.

As the saying goes, “Bears and bulls make money. Pigs get slaughtered.”

But the vast majority of investors focused myopically on their losses and left. Despite many people advocating to “buy low, sell high”, most investors mirrored the mistake of holding at the top – and sold at the bottom.

The same pattern repeated again and again.

I could’ve left (and I almost did)… My portfolio was in a world of hurt.

But I had seen this all before.

I was in crypto prior to 2017, survived, and profited immensely from previous crashes. And I will continue to do so well after this market correction.

Getting here has not been easy. I’ve taken many hits along the way. At one point, I lost more than 20% of my portfolio in a single day.

But I kept going, kept learning, and along the way, I discovered a few very important lessons

Lessons, had I known them when I first started investing, would have saved me years, and helped me avoid many of those soul-crushing losses.

Today, I’m going to share my experience with you and reveal the 3 most important crypto investing lessons I learned that helped me succeed… in a big way.

Everything I’ve learned from years of trading and talking to hundreds of leading investors, developers, and venture capitalists in the space.

At the end of this post, you’re going to understand why some crypto investors fail, and why others make incredible amounts of money.

But more importantly, with the market totally destroyed, you’ve been given a unique opportunity to re-enter and profit, just as the vast majority of investors leave.

To quote the old adage, “The time to buy is when there is blood in the streets”.

And right now the streets are pretty red.

Why Right Now Is the Biggest Opportunity in Crypto

I want to get right to the point with this one.

There are 3 extremely important trends here that you NEED to understand for this to make sense.

- Market corrections like this are cyclical and normal in crypto – Bitcoin has dropped in price over 10 times with losses of over 80-90% each time. Each correction is followed by a higher benchmarked price.

If you put emotions aside, you’ll see this as an undeniable fact.

2. The amount of tech innovation right now is massive – The level of development in most high quality projects is staggering. You can see hundreds of top level engineers leave major silicon valley companies and startups to flood into crypto.

Communities have popped up all around the world supporting app and protocol development.

3. We saw the exact same pattern in the Internet Bubble – A massive runup and then a huge correction. Crypto will follow the same trajectory.

The 2017 run-up was just the appetizer, and not the actual runup. With 24/7 markets, global capital and online platforms to invest I believe we have yet to see the real digital gold rush.

We still have massive growth ahead.

I mention all three of these points to help you think logically about where we are right now, not emotionally.

Crypto is a new technology; however, there are established patterns already and this market correction is following them perfectly.

I saw the same thing with the 2015 bear market, when more than 80% of investors left. I heard the same objections, the same news reports, and eventually the same angry people.

When 2017 started, it was like Deja Vu all over again.

But I was ready for it.

So What Makes Me Different? The 3 Secret Traits of Successful Crypto Investors

For the last 2 years I’ve been interviewing the most cutting edge projects and founders. I’ve spoken to over 100 projects and been to over 40 conferences and meetups.

I’ve seen hundreds of investors come and go, but I’ve also seen some of the same faces over and over again at every conference around the world.

Through all of this, I’ve observed that the successful investors all have something in common… I’ve narrowed down the 3 secrets tactics that all successful investors have.

I’m going to show you what they are so you can save time, think more effectively, and eventually beat the market.

Tactic 1 – High Quality Institutional Grade Data

It’s important to remember… “garbage in, garbage out”.

Your information diet in crypto will inform your investment choices, how you feel and most importantly – when you should exit.

The majority of retail investors consume such terrible second-hand information. Most of it isn’t based on facts or actual info from the team, but just summarized by other crypto investors.

By finding the best quality information, closest to the source as possible, you will set yourself up to have an information advantage not only over the market but over other investors as well.

The name of the game is information. It’s so valuable that in regular equities markets people go to jail for trading on privileged access to information.

But not in crypto. 🙂

Tactic 2 – Your Network is Your Net Worth

Wall street traders don’t hang out with regular guys who buy Vanguard mutual funds. They spend time with the other guys in the room. People who are smarter and just as equally connected as they are.

This allows them to maintain a sensitive informational advantage over the market. You need to do everything you can to network with high level investors, CEOs, developers and venture capitalists who are at the front lines of crypto.

Trust me when I say that knowing the right people in crypto can mean the difference from being in front of the wave to behind it.

Tactic 3 – Stay Ahead of the Curve, Not Behind It

The level playing field of crypto has made the premium on high quality information even higher. Low barriers to entry mean that crypto doesn’t require accredited investors but opens it up to anyone around the world.

Being ahead of the curve with a solid network and access to the highest quality information possible will help you maintain your position in the front of the pack and give you a massive strategic advantage over others.

A lot of people try to maintain this information advantage themselves, but it just isn’t possible. Trying to understand everything coming to the market is like trying to drink from a fire hydrant.

You just can’t stay up to date alone.

Institutional Grade Research for All Investors

At this point you might be thinking, “I don’t have time to do that much research or go to conferences”. I totally understand and crypto probably isn’t your full time job.

But it is ours.

For the last 3 years, we’ve been investing in crypto full time and built a team of more than 12 full-time people around me doing the same thing. We’ve had some great wins and some big losses.

Eventually, after making enough mistakes, we began to build our own research process, and a rock solid network of partners in the space. Slowly, we became the go-to voice in crypto for technical reviews.

(Check out our channel to see what we mean.)

Early on in 2017, we were approached by several large family offices and hedge funds who wanted to buy our research. We were reluctant as first, but eventually partnered with a few funds that shared our mission and values.

Fast forward six months, and all of our research clients have done very well. We were happy to help them, but our goal was not just to make the rich get richer. Working with “exclusive” funds was not in the spirit of decentralization that we had envisioned.

We were making a group of extremely wealthy people much wealthier, and it didn’t feel particularly rewarding.

So we decided to drop them as clients and build something new.

Something for all investors to give THEM the edge over big funds and family offices. We wanted to “level the playing field” so to speak and we have achieved it.

What’s Crypto Intel and Why Do You Need It?

Intel is for investors who understand the fundamental advantage of high quality information and network and want to avoid the time and stress of keeping up to speed with everything happening in crypto.

You will not get data like this anywhere else in crypto, plain and simple.

Crypto Intel is for the 1% of investors who want to be positioned to CRUSH the coming bull market.

We’ve been friends with the team at Investing Shortcuts for a while and respect their journey and hustle since they started.

We passed them a copy of Crypto Intel last month and they loved it. They asked if we could open up a few spots in our community for their members. As a favor to them we opened up 50 spots in Crypto Intel.

Click here to sign up and reserve your spot.

Why Only 500?

We believe that the information advantage of high quality data, especially about soon to come out projects that aren’t public, is severely diluted with too many people.

More is less and fewer people is better.

We structured Intel to have a max of 500 members.

So that’s it, thanks for reading and I really hope some of you internalize what I’m saying and don’t just brush this off because I can promise you when the next bull run comes around (which it will) you’re going to be scrambling to get the best information you can.

Onwards and upwards.

The Next Bull Run is Almost Here!

Join this FREE live event to learn why you need to rethink your approach to crypto investing before Q4 of 2018…

Catch The Next BIG Crypto Bull Run