In a previous piece, I outlined a way of owning stocks at a significant discount. There are several ways to achieve this, though, and this shortcut outlines a completely different way to get the same thing using call options—a big discount on stocks.

First, we need to go over a quick technical point—Delta is one of the drivers in option pricing. It is how much the price of an option will change with a given price change of the underlying stock.

So, a Delta of 100% would mean that if the underlying stock price went up 20c, the call option would also go up that amount. A very low Delta of 5% would mean if the underlying stock went up 20c, the call option would go up a measly 1c. Aside from a few technical points that we don’t really need to bother with, that’s pretty much all we need to know about Delta.

We can use Bank of America as an example. This is not a recommendation, but it is easier to explain the strategy with an actual stock.

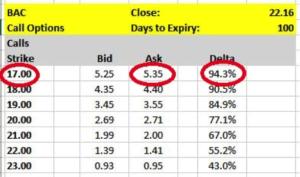

Here is a screenshot of some long dated BAC call options:

Long Dated BAC Call Options

The $17.00 strike calls are offered at $5.35. That means you would be buying the right (not necessarily the obligation) to buy BAC at $17.00. Your net price if you did exercise would be $17.00 plus that premium cost i.e. $22.35. The Delta on that option is 94.3%, so if BAC stock went up 20c, these options would go up 19c.

That net price of $22.35 is more than the current price of BAC and you wouldn’t get dividends as an option owner rather than the underlying. So why do I think this type of trade is often a good one?

Here are three reasons why you’re getting a huge discount on that stock:

- Cash. This is the big one. For stock, most investors have to put down 100% or a minimum of 50% of the cost of the underlying in a margin account. This trade requires only $5.35 of cash to be put down. If BAC was to go up substantially (and you wouldn’t do this trade unless you were bullish the name), your percentage gain would be four times as much as that done in the underlying in a cash account.

- Being shaken out of a position. Say the underlying stock owner had a $17.00 stop loss order. If the market took a tumble and recovered again – such as in a flash crash scenario – and the price went 1c below $17.00, the stock owner would be flat nursing a thumping loss. However the option owner would still be long his $17.00 call and get all that recovery.

- Delta adjustments in a sell down. Again, say the market had a 20% sell off but this time stayed roughly at that level. You would be able to sell that option at about $1.30 as the option would just be an ‘at the money’ one in a market of heightened volatility (which makes option prices higher). So, the underlying owner would lose about $5.00 but theoption owner would only lose about $4.00.

The key thing here is you have essentially bought a stock you wanted anyway, but for less than 25% of the actual cost.

For additional trading tips from Michael Cook, click here.